Planning | Investments | Life Insurance

Fee-for-service financial advisor

We serve a wide range of clients.

From those starting out & needing guidance, to owner-managers & executives or families with multi-planning needs, our clients have similar values and come to us seeking partnership to organize what they're currently doing.

Our Client Services

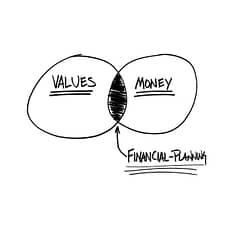

Perfect Planning is better than Perfect Products.

Financial Advice In A Nutshell

Protect Your Income. Grow Your Income. Replace Your Income.

Financial advice comes down to your income. Protecting it against a disability or death before retirement. Growing your income during your working years with a good investment strategy so as to replace your income or salary when you retire. Lastly, covering your basic expenses with some form of guaranteed lifetime income during retirement.

As a financial advisor in Toronto most of what we do is help you organize what you're currently doing so that you feel secure and confident today and in the future. We will never undo any good work you've done up to this point. There are many financial products, none of them perfect. Our job is to help organize it for you so that your income matches whatever life situation you're in.

Working With A Financial Advisor

Financial advice is only as good as the person you ask.

Independent Toronto Financial Advisor Providing You Choices.

When you work with it starts with your most urgent financial objective. Then your personal preference, whether you're hands on or hands off, and how much communication you require.

All that will determine the fee structure and types of investments and insurance solutions we recommend to you. Ultimately, your main objective is to see enough progress with your plan and ensure you cover off any gaps or vulnerabilities.

Welcome to Blue Alpha Wealth

Welcome to Blue Alpha Wealth, I'm Carter Njovana, independent financial advisor and partner in helping you gain control and security over your investments, insurance and financial needs analysis and planning. You'll find that having a discussion about how to simplify your situation helps to alleviate the anxiety that comes with planning your financial situation. I don't promise a silver bullet but promise to help make an improvement on your current situation. Get a feel for me if it's worth your while?

Not sure where to get started?

Get A Feel For Us. Fill Out the Form & We'll Get Back To You!

Buy your first home or help your children or grandchildren save faster!

The First Home Savings Account (FHSA) is a new type of registered savings plan established in 2022. As a hybrid of the RRSP and TFSA, it can help you save for your first home, tax-free.

A Financial Advisor So You Retire With Confidence

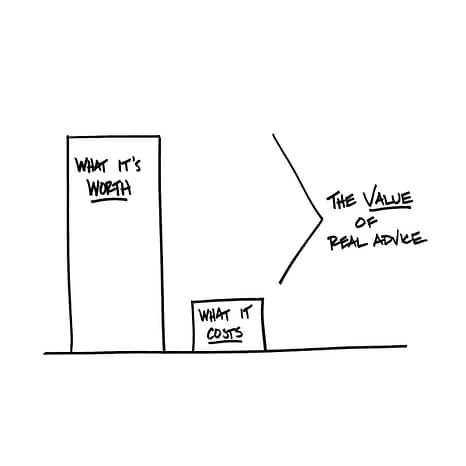

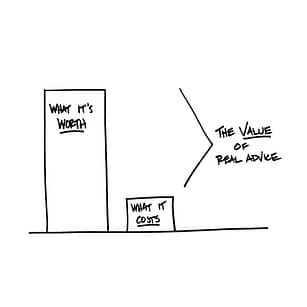

Working with a financial needs analysis planner like Blue Alpha Wealth is about empowering and enabling you to make smarter decisions about your future plans and investments as well as growing and protecting your nest-egg over time. Our priority as a financial advisor is to help you gain security and control over your finances. Working with us is also designed to reduce your anxiety and the amount of time you spend trying to figure out what, where and how given the information overload in financial news and commentary. We equip you with the knowledge and tools to feel confident that you will retire on your own terms. This is why working with a financial advisor is always a good bet!

Financial Advisor FAQs

It starts with having a conversation. A financial advisor is only as good as the satisfaction you get in them helping you achieve your goals and your belief that they can. By having a conversation you can determine if your personalities are suited and if you can work with them long term. Get in touch with us and we'll answer your questions.

A financial advisor is a broad term reflecting an individuals ability to help you with money management, insurance or general advice. A financial advisor can also be a financial planner. A financial planner helps you put your financial situation together and plan for specific goals like retirement, kids education and debt reduction.

The cost of advice can vary from one financial consultant to another. You could pay for consultation such as when you request a detailed financial plan. Or you could pay a fee based on the value of the investments that a financial advisor manages for you. BlueAlpha Wealth is a fee-based financial advisor meaning you don't pay us commissions but a fee based on our performance of your investments. In addition, if you require a financial plan we have different amounts depending on your need and complexity.

With the information age and the vast amount of information available to consumers, many are and do manage their own investments and financial planning. It's easier now to buy investments online without speaking to a financial advisor. There are some drawbacks and limitations, however, to DIY. Knowing when to buy a stock is easier than knowing when to sell. You also may not have the time and focus required to manage your affairs as your life gets more complicated. If you want to buy life insurance, you have to go through an advisor to be able to find you the best company and coverage. So it's a trade-off that one has to decide for themselves.

Most of what a financial advisor does is help you organize what you're currently doing as well as pointing out gaps and vulnerabilities to your financial situation. At BlueAlpha Wealth we will never undo any good work you've done up to this point. Our focus is to help you manage and plan so that you fulfill your goals. Whether it's investing smartly or mapping out a plan that takes into account your whole financial situation, we meet you where you are. We may also point out different strategies like alternative strategies and investing than you might be used to at your local bank.

Our main role at Blue Alpha Wealth is investment planning and management. However, this is not in a silo as we help you apply managing your investments to fund particular goals and plans you have for the future. We help you create a one-page financial and investment plan and manage it on your behalf. It's a long term relationship and for individual investors who want to delegate this responsibility as well as working together in partnership. If you have for example an RRSP, TFSA or any other type of investment services you need guidance with, that is what we mostly do.

No, our initial conversation is more introductory and an opportunity for you to know what working with us looks like and who we help. You never pay us directly for any solutions we recommend and implement.

Financial Advisor Services

Where is your money invested? Cash, fixed income, equities, Canada? Do you have a specific investment plan you understand? Do you feel it can be adjusted to better align with your goals? Are you paying attention to the amount of risk you're taking based on your time horizon and investment goals? We'll give you an objective view of what you are currently doing and briefly tell you our philosophy and how it can benefit you

How long can you go without your income or paycheque? How will it affect your lifestyle and your ability to plan for the future, let alone invest? Disability income insurance is insurance for your ability to earn an income in the event you can't work if you're sick or get injured. Get disability insurance for your specific occupation and the type of activities you perform in that occupation.

Why are you investing and why do you feel professional advice can help you? Have you attached specific goals to your money and how important is it that you reach these goals? This helps us understand what you're planning for and what steps best suit your situation and risk profile.

Are you curious about the fees you're paying or perhaps more aware given the media attention? Do you like the idea of portfolio management from experienced money managers that gives you access to different types of investment options typically used by institutions and pension funds? We can help you with this and show you the benefit of discretionary portfolio management.

Have you made yourself prepare for the fact that your retirement could last 20 to 30 years after you receive your last paycheque? It probably hard to consider that if retirement is a few years away but if its 5 to 10 years away it may be top of mind. Either way, the best way to secure a worry-free retirement is to set yourself up with some form of lifetime guaranteed income to cover your basic fixed expenses in retirement. This makes or breaks your retirement as worry about outliving your savings is the number one anxiety people have once they retire. We can project for you when you are likely to achieve financial independence given your savings and spending, and we adjust to get you to that retirement number only you know will remove anxiety.

Accumulation of your nest-egg and investing are usually the fun and easy part when it comes to building portfolios and attaching those to a particular financial goal. However, taxes, if ignored, can easily derail your plans or at least erode away at the progress you make if not planned properly. We maximize opportunities and tax savings tools by looking for ways to optimize your financial plan to minimize income taxes.

We offer group retirement plans with a capped management fee allowing more of your employees money to stay invested while investing in one of the worlds largest asset managers. It also allows administrators to manage the plan digitally and with less paperwork and hassle. This fully digital platform is 100% fiduciary and discretionary for employers, and it means less paperwork and administration, a simplified on-boarding process, and access to professional financial advice from Blue Alpha Wealth.

Curious About Getting Started?

Blue Alpha Wealth