Create A Guaranteed Income Stream.

Find the Best Annuity Rates In Canada.

Annuities are great way to create lifetime, fixed retirement income. Your annuity rates & income are guaranteed for life.

How To Ensure A Worry-Free Retirement & Never Run Out of Money

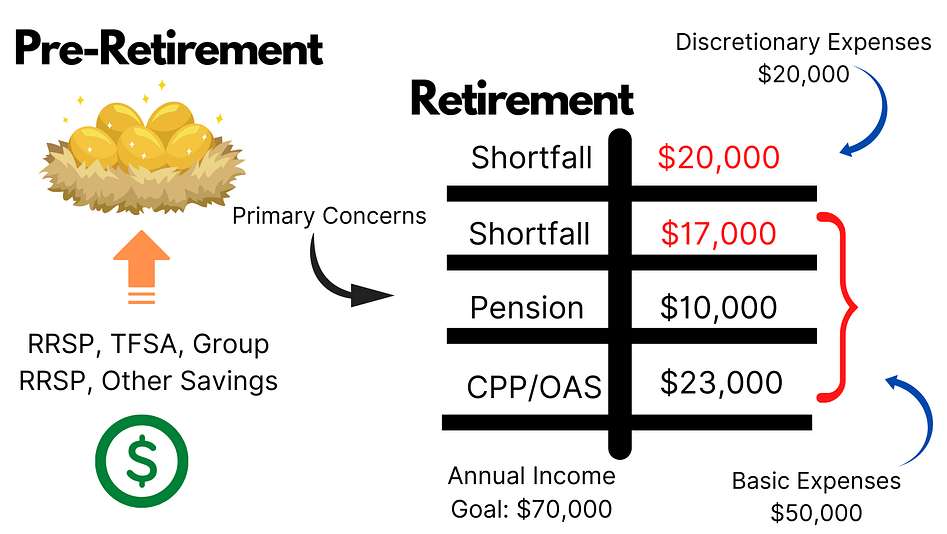

Make sure to cover basic expenses in your retirement plan

When working with a retirement planner one of the most important things to address is how you will comfortably cover the expenses you need to live out your retirement.

It makes sense that most people would focus only on accumulation in pre-retirement years but most retirement planners don't point out the equally important distribution phase once you stop working. One of the alternatives to taking RRIF payments at age 71 is to use an annuity whereby you convert a portion of your nest-egg to meet this need.

The image below shows what to consider and how to think about covering all aspects of your retirement plan.

Current Annuity Rates in Canada.

As a Blue Alpha Wealth client you can rest assured knowing that you're able to compare all available insurance companies and get the highest payout for your deposit. Companies we work with include Canada Life, Sun Life, RBC, BMO, Desjardins, Equitable Life, Empire Life and more.

Manulife has recently gotten back into the annuity market since 2023

Current Updated Lifetime Annuity Rates for 2024

Annuity Rates for MALE - RRSP/RRIF - Per $100,000 Deposit

*Previous MONTHLY Rate in Brackets*

Age 50 - $469.36 ($464.00)

Age 55 - $498.76 ($493.72)

Age 60 - $537.16 ($540.06)

Age 65 - $588.54 ($588.85)

Age 70 - $654.77 ($651.08)

Age 75 - $735.41 ($731.05)

Age 80 - $832.62 ($828.52)

Annuity Rates for FEMALE - RRSP/RRIF - $100,000 Deposit

Age 50 - $451.67 ($446.17)

Age 55 - $475.44 ($470.83)

Age 60 - $507.67 ($506.33)

Age 65 - $551.97 ($552.66)

Age 70 - $611.32 ($610.19)

Age 75 - $686.18 ($681.69)

Age 80 - $784.29 ($780.09)

***These rates are based on a single life with payments made to you for life with a 10 year guarantee 0% indexing.

How to Use An Annuity for Retirement

By way of example, assume you determine that you require $70,000 in annual income to support your whole retirement. The example below gives you a high-level guide on how to calculate what you will need to cover in terms of shortfall so you don't run out of money.

Canada Annuity basics

Annuity Rates 101

When it comes to getting the best annuity rates, there is no one size fits all solution. A lot depends on how much guaranteed income you are looking for, when you need it and how much you want to put towards the annuity contract. Depending on your retirement income needs and situation, you may need 20% or maybe 40% of your retirement nest-egg to give you the income you need.

You may need a short term solution like income for 10 years or lifetime coverage. Regardless, your annuity rates all depend on the nature of your situation and need for retirement income.

The Basics

The best way to understand annuities is to think of them as the opposite of life insurance. While life insurance is meant to protect or insure your family in the event of your premature death, an annuity is meant to protect you or insure your retirement in the event you live too long. Simply put, you buy life insurance because you will die too soon and you buy annuities because you worry about running out of money due to long life.

Annuity is like a pension

Similar to coveted public pension plans that provide iron-clad guarantees, annuities provide individuals with a regular stream of income for life. Unlike GICs, the amount you receive is not dependent on interest rates and unlike equities, there is no worry of volatility in prices. While a rise in stock market prices protects against inflation better than GICs and interest rates, annuities also provide protection against inflation through indexing. The nice thing about buying an annuity is that it's a one-time purchase giving you a lifetime of guaranteed payments. You also won't have to worry about fluctuating GIC rates.

Are you at risk of living a "just-in-case" retirement?

Are you worried about running out of money and keeping money in a bank account just in case you run out of money or perhaps you need money for medical expenses? Just in case you don't have enough to leave an inheritance to your loved ones, are you not living the retirement you always dreamed of and wanted? Annuities are a great way to take away the anxiety of living a just-in-case retirement. We can help you find the best annuity rates to suit your lifestyle and income needs.

2 Key Questions To Ask Yourself Regarding Your Retirement

Most people and particularly those nearing or in retirement can tell you how much money they have in their portfolio. The problem, however, is that most can't tell you how much they can get from that nest-egg.

It's important because retirement is when you replace the income you've made during your working years with the nest-egg you've built up.

What this guaranteed income will help you do is remove the key retirement risks namely:

The success of your retirement planning will NOT depend on your assets or how big your nest-egg is.

- 1How much guaranteed lifetime income do I have or need?

- 2Have I removed or addressed the key retirement risks?

Canada Pension Plan & Old Age Security

Things to consider before taking CPP/OAS.

What is the ideal age to take CPP?

This is a common question retirement planners get from people in the mid 50's going to age 60. In general, you can start collecting CPP payments anywhere between your 60th birthday and 70th birthday. Some might consider taking CPP past age 70 but in reality there is no real benefit in doing so. You qualify for CPP as long as you made at least one payment after age 18. You can apply for the start of payments the month after you turn 59 years old OR up to one year in advance before you know you're going to take it.

CPP vs OAS?

Keep in mind that CPP and Old Age Security (OAS) are two separate payments you receive from the government. OAS is eligible from age 65 to age 70. The most important point is that if you apply for CPP at age 65 you aren't obliged to apply for OAS at the same time and the opposite is true. Each one is separate and you should apply as you see fit for your situation.

How much CPP payment can I expect to get?

The maximum you're allowed can for CPP in 2021 is $1,203 but on average you can expect a payment of about $688. It all depends on your situation. The best way to find out what you qualify for is to create an account or login to My Service Canada here to see your estimate of CPP.

Do I automatically start getting payments?

You need to apply as the government won't automatically start making payments. Because it's income that is taxable in your hands it's important to plan it out with your retirement planner to see how to tax efficiently apply it to your retirement income plan to avoid such things as OAS clawback.

Note: It's always important to determine what age works for you and to discuss with a retirement planner like Blue Alpha Wealth. The mistake many people make is basing this decision on what a friend or neighbor did. This is why it's important to understand why you should be taking it at certain ages depending on your situation.

Penalty for taking CPP before age 65?

If you decide to start collecting CPP before your 65th birthday, the amount that you will get will be reduced by 0.60% for every month that you take it early. For example, if you take CPP at age 60, your amount is effectively reduced by 36% (0.60% for 60 months).

For each month that you delay taking CPP after your 65th birthday, you get a 0.70% increase in your CPP payment! This is a 40% increase in your payment if you take it on your 70th birthday.

Get An Annuity Quote

Annuities from top life insurance companies

Have you considered your long term healthcare in retirement?

Who is going to take care of you when you no longer can and where is the money going to come from?

Use a HomeCare assistance insurance plan together with an annuity to ensure you protect your retirement

Do You Have A Defined Contribution Pension?

Transferring Your Defined Contribution Pension to An Annuity

A Defined Contribution (DC) Plan is a type of Group RRSP workplace pension plan most commonly used in Canada. It allows the employee to save for retirement through payroll deductions with the hope that it helps the employee save for retirement. Typically an employer matches a percentage of the contribution and in some cases they may not. The main difference between a defined contribution pension plan and defined benefit plan is the responsibility for the success of the plan to fund your retirement.

Why you should consider transferring your DC Pension Plan to an annuity:

The happiest people in retirement are those who have some kind of pension-like income.

Taxation of Annuities

Registered Income vs Non-Registered Income Payments

In general, payments or income you receive from a registered annuity are taxed 100% in the year you receive it as an annuitant. In contrast, income or payments you receive from from non-registered account annuities are treated on a non-prescribed (accrual accounting) or prescribed taxation treatment. When you buy an annuity contract from a life insurance company your series of income payments are made up of two components: return of capital and interest income. Your capital portion is not taxed but the interest is taxed and the way its taxed depends on whether you choose "prescribed" or "non-prescribed" taxation at the time of policy issuance.

What Is A Prescribed Annuity?

A prescribed life annuity is a type of annuity that has a fixed or level taxation structure which has the benefit of spreading out your tax burden evenly over the life of the annuity policy. Opting for either prescribed or non-prescribed annuity taxation doesn't affect the amount of income you will receive. It will, however and more importantly, affect your after-tax income calculation.

- If you choose non-prescribed taxation: the interest income is fully taxed at your marginal tax rate whereby you pay more tax in the beginning then less tax over the years as it tapers off over time.

- If you choose prescribed taxation of your annuity you will receive greater after-tax savings and benefits. Based on Canada Revenue Agency policy, prescribed annuities receive level taxable income and preferred tax status. Prescribe annuities are unique to non-registered accounts.

In Canada withholding tax is compulsory for annuities purchased with Life Income Fund (LIF), Deferred Profit Sharing Plan (DPSP) and Registered Pension Plan (RPP)premiums. It doesn't matter if the account is locked-in or not locked-in. For non-resident Canadians, the applicable withholding tax rate is deducted for any annuity contract that has been bought.

Who Qualifies for A Prescribed Annuity

In general most people can qualify for prescribed annuities and the tax favored status they receive as long as you can demonstrate the following:

Perfect Planning is better than Perfect Annuity Rates

Annuities are not a perfect product. Some media outlets and some financial professionals will criticize annuities mainly because they misunderstand how they work and incorrectly compare them to investments. Annuities are not investments. As a result it confuses consumers.

Annuities play a distinct role in retirement. They take away longevity risk which is the risk that you'll live too long. So, rather than focus on the product focus on what the product does. Then plan perfectly!

8 Tips For Finding the Best Annuity Rates in Canada

Look at different companies

Don't go directly to an insurance company. Certain companies have different features you may miss out on by sticking with one company. Shop around!

Consider your income objectives

Are you trying to solve a particular problem related to income in retirement. How much can you comfortably put away to solve this problem?

Don't put all your money in an annuity

An annuity isn't perfect but meant to help retirees avoid running out of money. Assigning a portion of your RRSP for example helps solve the problem.

Consult with an annuity broker

Blue Alpha Wealth is a licensed annuity broker and can help you determine which annuity is best for you and which company features apply to your situation.

Annuity isn't an investment

An annuity isn't like equities or GICs. An annuity is not an investment subject to fluctuations but a promise from the insurance company to pay guaranteed income.

Diversify annuity companies

Buying annuities from 2 or 3 different companies is a great way to diversify and take advantage of different features each company provides.

Understand the contract terms

Make sure to understand the terms and conditions of your contract. Most contracts typically have a 10-day free look period whereby you can cancel if you have buyers remorse.

Understand surrender fees

Things can change in the future even though you felt an annuity was a good idea, and you need access to funds. Understand your obligations and penalties.

10 FAQ About Annuities & Rates in Canada

When looking into annuity rates and the appropriate annuity contract to buy as part of your retirement income planning, there are a few questions and considerations to keep in mind.

When is the best time to buy an annuity?

In short, anytime you need guaranteed income. However, when it comes to retirement, any time you worry about running out of money and living long and need some lifetime income.

How does an annuity work?

You choose how much income you need, you give an insurance company a deposit amount based on the time and income you need, and they pay you that guaranteed amount risk-free.

Who is the annuity contract made out with?

An annuity is a contract between you and a life insurance company. Life insurance companies are highly rated and secure to guarantee payment of your income amount.

How are life insurance companies able to guarantee paying?

Life insurance companies use what are called 'mortality credits'. In a pool of 5 people with annuities, over time some may pass away and those who live longer benefit i.e. mortality credit

What happens to my money if I pass away?

If you have a joint annuity contract the income continues to the spouse. A single annuity contract can go to named beneficiaries as well as after second spouse dies. Best is to plan for this.

How are my annuity rates calculated?

Life insurance companies use your age, the amount of income you need, how long you need income, your gender and other mortality actuarial factors to calculate your annuity rates.

Is my annuity covered by deposit insurance like GICs?

The life insurance company that issues your annuity is covered by Assuris for up to $5,000 monthly or 85%of the promised monthly benefit depending on which one is higher.

What to do if I need more than $5,000 a month in annuity income?

Similar to how you would buy GICs, you can spread your income with different life insurance companies to meet your income goals whilst protecting yourself against life insurance company default.

Who should I buy an annuity from?

A licensed annuity broker can get you the best and most current annuity rates in Canada to suit your needs. We recommend you buy from Blue Alpha Wealth! Call us at (416)966-0606.

Let Us Help You Get the Best Annuity Rates for Guaranteed Retirement Income

LET'S GET STARTED!

Get An Annuity Quote

Annuities from top life insurance companies