FHSA: Get ahead on first time home ownership for yourself, your kids or grandkids with the First Home Savings Account

The Tax-Free First Home Savings Account

An Overview of the FHSA

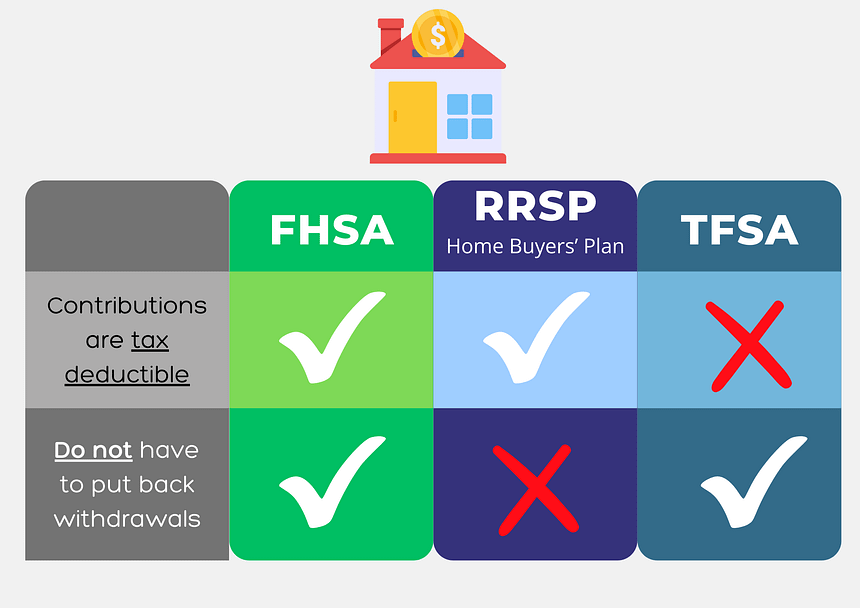

Yes! When it comes to registered savings account options for your first home purchase in Canada, the FHSA is, on paper, more advantageous than the Home Buyers' Plan. Firstly, you can use up to $40,000 with the First Home Savings Account vs $35,000 of your RRSP savings using the HBP for a first home purchase. Secondly, the FHSA doesn't require you to repay the amount withdrawn, whereas the HBP mandates that you put back the withdrawn amount within 15 years from withdrawal.

All your contributions (maximum of $8,000 a year and $40,000 lifetime) into your FHSA reduces your taxable income similar to an RRSP. Of the money you invest or seek out interest or income, you earn this tax-free similar to a TFSA. When it comes to withdrawal to purchase your first home, they don't need to be paid back. And you can contribute up to $8,000 each year, up to a max of $40,000 in total.

Perhaps the main 'disadvantage' of FHSAs is that you must purchase a house within 15 years of opening one. It doesn't necessarily mean you will lose your savings and the tax benefits if you don't use the funds to purchase your first home as you can roll your FHSA contributions into an RRSP without impacting your RRSP contribution room.

The Home Buyers’ Plan has a “minimum holding period”. Unlike the HBP, the FHSA has no limitations as far as a minimum period of time that money must be held in your FHSA before contributions can be withdrawn.

According to the federal government rules: "Your maximum participation period begins when you open your first FHSA and ends on December 31st of the year in which the earliest of the following events occur: the 15th anniversary of opening your first FHSA; you turn 71 years of age; the year following your first qualifying withdrawal from your FHSAs."

Although as a parent you can't contribute directly to your child's or grandchild’s FHSA, you can gift the funds to that child so they can make a deposit into their own personal FHSA. The main consideration is that all the benefits and tax deductions will be in the name of the child and none attributed to the parent or grandparent.

According to the federal government rules on December 27, 2023: "you must not have acquired the qualifying home more than 30 days before making the withdrawal. You must be a resident of Canada from the time that you make your first qualifying withdrawal from one of your FHSAs until the earlier of the acquisition of the qualifying home, or the date of your death."

The FHSA adopts an important feature of the Tax Free Savings account which is that all your investment gains are "tax-free". On the other hand, with the FHSA, similar to an RRSP you get a tax deduction for your contribution made whereas with the TFSA you don't get a tax deduction. Lastly, the FHSA only allows a maximum contribution of $40,000 lifetime whereas the TFSA allows continuous contributions beyond $40,000. Ultimately whether the FHSA is better than the TFSA depends on your investing and saving goals. However, if your main goal is to put a down payment on a home and get a tax benefit today for doing that, the FHSA is a great way to start. Keep in mind as well, you can also use the TFSA to add to the $40,000 you use from the FHSA to have a bigger down payment...if you had already started using a TFSA to save.

FHSA Contribution Limits.

$8,000/Year

$40,000/Lifetime

- Can carry forward your available contribution up to $8,000 cumulative

- Have option to transfer from your RRSP

- Your contribution can be:

- Deducted in the current year OR

- Carried forward indefinitely

Only the individual qualified FHSA holder can contribute to their own account — not a spouse or common-law partner. Similarly, if the spouse gifts money to their spouse, only the eligible First Home Savings Account holder (spouse) can claim the accompanying tax deductions for contributions to the account.

If you use your FHSA to make your first home purchase, you can withdraw the entire amount from your account tax-free similar to a TFSA. However, there is a lifetime limit of $40,000 and an annual limit of $8,000. When you make a withdrawal, the investment income or interest earned is added to the amount you contributed. It's always good to make a plan that takes into account your overall financial picture.

Just like a Tax Free Savings Account, you can get standard interest rate like you would in a savings account at your local bank. However, you can invest in other types of investments like mutual funds, GICs, stocks and bonds which would be related to your appetite for risk and how long you need to save the money for. To find the "best" rate of return you require it's important to have a conversation with an advisor like Blue Alpha Wealth.

Yes, similar to a TFSA and RRSP, you can have multiple First Home Savings Accounts. As long as you remain within the yearly maximum of $8,000 and the lifetime maximum of $40,000, you can have as many as you want. One way in which you could use multiple FHSA accounts is to spread out the risk of investing your money. Because you want to grow your money more than the bank interest rate you can use $4,000 for example to buy medium to long term (5 years) investments like mutual funds and stocks. You can then use the remaining $4,000 to buy more 'safer' investments like a Guaranteed Investment Certificate (GIC) that pays a reasonable interest rate for example 5% compounding for 5 years.

For a legally recognized union or common-law status in Canada, homeownership applies to both partners regardless of whose name is on the deed. However, if you do have an FHSA when you get married or become common-law, you will still be allowed to contribute to it if you wish, and its timelines and rules will remain the same.

According to the FHSA primary residence and qualified withdrawal rules, a property you intend to live in and partially rent out could qualify for a tax-free withdrawal, but only if it is primarily used as your home and secondarily as a rental property.

As the name suggests, the First Home Savings Account, the use of the plan can only be applied to your "First Home" and based on your age and residency. In addition, any withdrawals you make can only be used towards the purchase of a qualifying home. Otherwise, your withdrawal would be taxed unless it's transferred without affecting your contribution room to an RRSP.

Not directly. An FHSA can only be opened and be for the use of one qualified person as who is at least 18 years old, a resident of Canada and as long as you haven't lived in a qualifying home owned by either yourself or your spouse or common-law partner either this year or in the previous 4 calendar years. Another individual can gift you money to make a contribution but they will not have the tax benefits attributed to them.

To withdraw your funds, you must follow the qualification rules which establish that you be a first time home buyer buying or building a qualifying home in Canada, have a written agreement to buy or build before October 1 of the year subsequent to the year you make the withdrawal and intend to move in within a year of buying and building. You can withdraw funds from your FHSA for the purchase of your first home at any time. Funds must also be used to purchase, build or renovate a qualifying home within 15 years of the date of application.

Timelines & Withdrawals from FHSA

FHSA Withdrawal Rules

To be able to withdraw funds from an FHSA on a non-taxable basis, you must meet certain guidelines and conditions: you cannot have lived in a home that you owned either in the four previous years, or in the year of withdrawal (other than 30 days prior to the withdrawal).

Before October 1 of the year following the year of withdrawal, you must also have signed a written agreement to buy or build the home. You must intend to occupy that home as your principal residence no later than a year after acquisition, and it must be purchased or built in Canada. You must also be resident in Canada throughout the period from the time of the withdrawal until the time when the home is acquired.

If you meet the conditions, the entire balance in the FHSA can be withdrawn on a tax-free basis in a single withdrawal or a series of withdrawals.

Get started with your First Home Savings Account (FHSA)

Fill out the form to get in touch with us and we'll get back to you as soon as possible.

FHSA vs RRSP vs TFSA

The FHSA should not be considered as a replacement to the RRSP or TFSA but as a hybrid registered account that takes unique benefits of the RRSP and TFSA but being specifically geared towards buying a first home. Just like the RRSP and TFSA you get:

- Additional contribution room ($5,000) than using the Home Buyers' Plan

- Additional tax savings by getting a deduction and tax-free growth

- When you invest you get more opportunity for investment growth with no taxes.

Mechanics of the First Home Savings Account

Setting up an FHSA - Opening & Closing

To setup and open an FHSA, you must be a resident of Canada and at least 18 years of age. Moreover, as the name suggests, you must be considered a qualified 'first time home buyer'. What that means is that you have not owned a home in which you have lived or resided "at any time during the part of the calendar year before the account is opened or at any time in the preceding four calendar years" (Canada Department of Finance, 2022). In terms of definition of 'ownership' this is defined broadly and includes beneficial ownership, but does not include an assumed right to obtain less than 10% of what is considered a qualifying home.

Your account would cease to be an FHSA and you would forfeit your right to open an FHSA, after December 31 the year in which the earliest of these events occurs:

- The fifteenth anniversary of the individual first opening an FHSA; or

- The individual turns 71 years old.

If there is a leftover amount you don't use towards the purchase of a fist home that is considered a qualifying home, you can transfer that amount tax-free to an existing or new RRSP account or to a RRIF if you are over age 71. If you opt not to transfer to an RRSP or RRIF, you can withdraw but that amount would be fully taxable. The qualifying withdrawals could be transferred until December 31 of the year following the year of their first qualifying withdrawal.

FHSA Reporting Requirements

Buy your first home or help your children or grandchildren save faster!

The First Home Savings Account (FHSA) is a new type of registered savings plan established in 2022. As a hybrid of the RRSP and TFSA, it can help you save for your first home, tax-free.

FHSA Scenarios for Different Life Stages

Scenario 1: "Get a head start"

Sarah, Age 26

Contributes $8,000 yearly max until the lifetime maximum of $40,000.

After 6 years Sarah withdraws the funds ($40,000 + investment growth) from her FHSA to put towards her first home purchase.

Scenario 2: "The power of gifting"

Susan, Age 76 - Grandparent

Hannah, Age 27 - Doesn't own a home

Hannah opens an FHSA with Blue Alpha Wealth.

Every year for 5 years, Susan gifts Hannah $8,000 to contribute towards her FHSA. Hannah gets the tax deduction.

After 8 years Hannah withdraws the funds ($40,000 + investment growth) from her FHSA to put towards her first home purchase.

Scenario 3: "Create more RRSP room"

Kevin, Age 60

Divorced 6 years ago and renting his home ever since.

Has no intentions of ever buying a home again in the future.

Opens an FHSA and contributes $8,000 annually.

Enjoys the tax deductions that his FHSA contributions afford him without affecting his RRSP contribution room.

Kevin later transfers his FHSA funds (contributions + investment growth) to his RRSP, without requiring or using RRSP room.

Scenario 4: "Rental property owner"

Anjali, Age 44

Owns three properties she rents out to others, but lives in a property she rents from someone else.

Does not own a home as her primary residence and has not in the previous four years.

Opens an FHSA and contributes to it.

Enjoys the tax deductions that his FHSA contributions afford him without affecting his RRSP contribution room.

Later either withdraws funds from FHSA to purchase a home or transfer the FHSA funds to an RRSP.

Scenario 5: "The couple who don't live together"

Thandie, Age 33 - owns a home

Aaron, Age 35 - does not own a home

Thandie and Aaron plan to get married but do not live together yet.

Aaron opens an FHSA before getting married. They get married and Aaron moves in with Thandie.

Opens an FHSA and contributes to it.

Aaron enjoys the tax deduction of the FHSA until he decides to put it toward a home or, if necessary, transfer it to an RRSP without effecting his contribution room.

Scenario 6: "Couple live together but not yet common-law"

Dave, Age 33 - owns a home

Jessica, Age 35 - does not own a home

Dave and Jessica live together but are not yet common-law spouses.

Dave and Jessica plan to buy a home together.

Jessica opens an FHSA before they are considered common-law spouses.

Jessica enjoys the tax deductibility of the FHSA until she and Dave purchase a home together and Dave withdraws the funds tax-free.

What types of homes qualify for an FHSA

FHSA QUALIFYING HOMES

Using definitions from the RRSP Home Buyers' Plan, we can determine what would be considered a qualifying home and one not considered as qualifying. What qualifies as a ‘home’ is central to the eligibility of an FHSA. You can only open an FHSA or make a tax-free withdrawal if you or a spouse have not lived in a home you’ve owned in the year you open the FHSA or in any of the last four calendar years, and withdrawals can only be made towards purchasing a qualifying home.

This table will help provide guidance on what constitutes a qualifying home and what doesn't.

INCLUDED Qualified Homes | NON-QUALIFIED Homes |

|---|---|

Condominium Units | Homes Outside Canada |

Detached & Semi-Detached Homes | Warehouse & Storefronts |

Townhouses | Undeveloped land not currently being converted to qualifying home |

Mobile Homes | Vacation homes not considered as primary residence like cottage |

Homes Currently Being Constructed e.g. Custom Homes | Property or home where you only have tenancy rights |

Get started with your First Home Savings Account (FHSA)

Fill out the form to get in touch with us and we'll get back to you as soon as possible.