Who We Help

Financial Needs Analysis Planning Toronto

Do You Prefer to Delegate and Value Guidance?

our process

Discover how we make a difference for clients

We provide the greatest impact by matching our expertise to individuals, families and business owners who see value in working with a planning professional.

Our focus is helping you build and protect your wealth and, more importantly, create a sustainable income in retirement.

Our Typical Clients Are:

Committed Savers

A good financial and investment plan is only as good as your commitment to it. You might have a goal to retire at 60 but are you committed to saving towards that? The families we serve have worked hard and saved diligently and need advice understanding if their savings are positioned to support their current and future needs.

Focused On Retirement

Saving for retirement by investing is meant to create a source of sustainable income to replace your salary/income once you stop working. If you seek guidance as you prepare for and transition into retirement and want to understand the different options for sustainable cashflow in retirement, our expertise can help.

Want To Delegate To A Professional

Our clients would like to be involved in their investment planning but need someone to actively manage it on their behalf with their input. Blue Alpha Wealth clients value their time and energy and place emphasis on using experts to delegate responsibilities like investment management.

Seek To Create Sustainable Retirement Income

Our clients biggest worry is whether they will outlive their retirement savings and how to save and invest appropriately. Nest-egg accumulation is the easy part for most people. It's figuring out how to spend that money in retirement sustainably that causes the most anxiety. We help clients create a pension-like stream of income with a portion of their nest-egg to ensure a worry-free retirement.

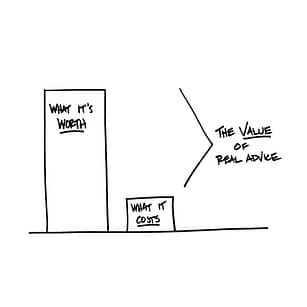

Value Professional Advice

We work with sincere and nice people and our goal is to make a difference in their lives. We've found that we can't be all things to all people, however, we do our best to meet people where they are. You have many options out there but as most people have realized, nothing replaces human advice and guidance.

Financial Advice is only as good as the person you ask.

There are so many products and financial advisors that it's hard to tell the difference sometimes. However, in the long run it makes a difference.

Sound Like You? Get A Feel For Us:

Financial Needs Planning So You Feel Confident

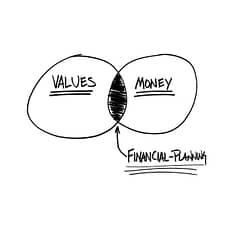

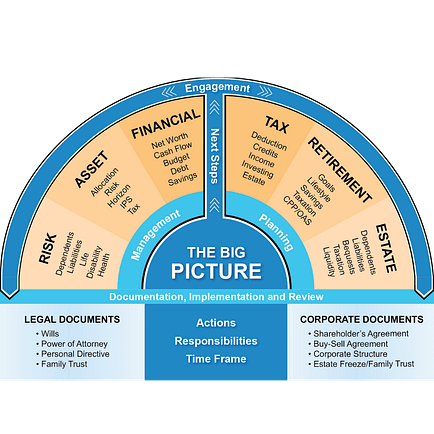

Working with a financial needs analysis planner like Blue Alpha Wealth is about empowering and enabling you to make smarter decisions about your future plans and investments as well as growing and protecting your nest-egg over time. Our priority is to help you gain security and control over your finances. Working with us is also designed to reduce your anxiety and the amount of time you spend trying to figure out what, where and how given the information overload in financial news and commentary. We equip you with the knowledge and tools to feel confident that you will retire on your own terms.

Curious About Getting Started?

Blue Alpha Wealth

Financial Needs Analysis Planning in Toronto

Perfect financial needs planning is better than perfect financial products. Beyond that slogan, we also believe that advice is only as good as the person you ask. We meet you where you are and help you navigate your investments and planning so it makes sense and builds the future you envision.

Financial needs analysis planning is not a static set it and forget it event. It's an ongoing process that enables you to make better decisions and is much more than your investment portfolio or financial news media. Financial planning is what you want to get from it.

Planning & Investment Services

It starts with having a conversation. A financial advisor is only as good as the satisfaction you get in them helping you achieve your goals and your belief that they can. By having a conversation you can determine if your personalities are suited and if you can work with them long term. Get in touch with us and we'll answer your questions.

A financial advisor is a broad term reflecting an individuals ability to help you with money management, insurance or general advice. A financial advisor can also be a financial planner. A financial planner helps you put your financial situation together and plan for specific goals like retirement, kids education and debt reduction.

The cost of advice can vary from one financial consultant to another. You could pay for consultation such as when you request a detailed financial plan. Or you could pay a fee based on the value of the investments that a financial advisor manages for you. BlueAlpha Wealth is a fee-based financial advisor meaning you don't pay us commissions but a fee based on our performance of your investments. In addition, if you require a financial plan we have different amounts depending on your need and complexity.

With the information age and the vast amount of information available to consumers, many are and do manage their own investments and financial planning. It's easier now to buy investments online without speaking to a financial advisor. There are some drawbacks and limitations, however, to DIY. Knowing when to buy a stock is easier than knowing when to sell. You also may not have the time and focus required to manage your affairs as your life gets more complicated. If you want to buy life insurance, you have to go through an advisor to be able to find you the best company and coverage. So it's a trade-off that one has to decide for themselves.

Most of what a financial advisor does is help you organize what you're currently doing as well as pointing out gaps and vulnerabilities to your financial situation. At BlueAlpha Wealth we will never undo any good work you've done up to this point. Our focus is to help you manage and plan so that you fulfill your goals. Whether it's investing smartly or mapping out a plan that takes into account your whole financial situation, we meet you where you are. We may also point out different strategies like alternative strategies and investing than you might be used to at your local bank.

Our main role at Blue Alpha Wealth is investment planning and management. However, this is not in a silo as we help you apply managing your investments to fund particular goals and plans you have for the future. We help you create a one-page financial and investment plan and manage it on your behalf. It's a long term relationship and for individual investors who want to delegate this responsibility as well as working together in partnership. If you have for example an RRSP, TFSA or any other type of investment services you need guidance with, that is what we mostly do.

No, our initial conversation is more introductory and an opportunity for you to know what working with us looks like and who we help. You never pay us directly for any solutions we recommend and implement.

Where is your money invested? Cash, fixed income, equities, Canada? Do you have a specific investment plan you understand? Do you feel it can be adjusted to better align with your goals? Are you paying attention to the amount of risk you're taking based on your time horizon and investment goals? We'll give you an objective view of what you are currently doing and briefly tell you our philosophy and how it can benefit you

How long can you go without your income or paycheque? How will it affect your lifestyle and your ability to plan for the future, let alone invest? Disability income insurance is insurance for your ability to earn an income in the event you can't work if you're sick or get injured. Get disability insurance for your specific occupation and the type of activities you perform in that occupation.

Why are you investing and why do you feel professional advice can help you? Have you attached specific goals to your money and how important is it that you reach these goals? This helps us understand what you're planning for and what steps best suit your situation and risk profile.

Are you curious about the fees you're paying or perhaps more aware given the media attention? Do you like the idea of portfolio management from experienced money managers that gives you access to different types of investment options typically used by institutions and pension funds? We can help you with this and show you the benefit of discretionary portfolio management.

Have you made yourself prepare for the fact that your retirement could last 20 to 30 years after you receive your last paycheque? It probably hard to consider that if retirement is a few years away but if its 5 to 10 years away it may be top of mind. Either way, the best way to secure a worry-free retirement is to set yourself up with some form of lifetime guaranteed income to cover your basic fixed expenses in retirement. This makes or breaks your retirement as worry about outliving your savings is the number one anxiety people have once they retire. We can project for you when you are likely to achieve financial independence given your savings and spending, and we adjust to get you to that retirement number only you know will remove anxiety.

Accumulation of your nest-egg and investing are usually the fun and easy part when it comes to building portfolios and attaching those to a particular financial goal. However, taxes, if ignored, can easily derail your plans or at least erode away at the progress you make if not planned properly. We maximize opportunities and tax savings tools by looking for ways to optimize your financial plan to minimize income taxes.

We offer group retirement plans with a capped management fee allowing more of your employees money to stay invested while investing in one of the worlds largest asset managers. It also allows administrators to manage the plan digitally and with less paperwork and hassle. This fully digital platform is 100% fiduciary and discretionary for employers, and it means less paperwork and administration, a simplified on-boarding process, and access to professional financial advice from Blue Alpha Wealth.