Retirement Planner in Toronto

Helping You Navigate Pre-Retirement and Retirement.

When it comes to your Retirement Planning...

Do You Know Where You Stand?

The success of your retirement planning will NOT depend on your assets or how big your nest-egg is.

Your assets can be lost, stolen, sued, swindled, divorced or crushed in a market meltdown.

2 retirement questions to ask yourself

What is Retirement Planning?

Most people think of investing and the stock market when they think about retirement planning. As a result, the focus becomes accumulation without an eye on what you will do once you stop receiving a regular paycheque from your workplace. Or they might envision travel and all the fun things we think about when we no longer have to work.

Retirement planning is basically replacing your income/salary once you retire. This could be for 30 or more years. You will need sustainable income to support your basic expenses and lifestyle. The trouble with focusing on accumulation is that the stock market is volatile and depending on that is risky. Below are the 5 steps to a successful retirement and working with a retirement planner.

4 Steps To A Successful Retirement Plan in Canada

Cover Basic Lifetime Expenses

Most people don't plan for their basic expenses when you consider you may have a 30+ year retirement. Using guaranteed lifetime income in the form of an annuity using a portion of your nest-egg, is still the most effective and secure way to do this. Decide how much money you need to lead your normal retirement short of CPP and OAS payments.

Protect Against Inflation

Inflation runs anywhere between 2.5% and 3%. Once you've taken care of your basic expenses, you want to optimize your investment portfolio for inflation. Many folks, because they worry about running out of or losing money in the stock market, tend to buy "safe" investments like GICs or savings accounts. If you've taken care of basic expenses this isn't a major worry.

Have a Plan for Long Term Care

If you're living longer and for 30 years in retirement, chances are your health may eventually be affected. Or in most cases you get to a point where you need assistance with living and not having to worry about maintaining a home. Long term care insurance. NO retirement plan is complete without considering long term care. As a retirement planner, Blue Alpha Wealth can help you understand your options.

Permanent Life Insurance

If you're worried about taxes or leaving an inheritance without sacrificing your retirement, life insurance is the most efficient tool to accomplish that. Pass wealth to your children or charities without having to live a "just-in-case retirement". Just in case the roof leaks or there's not enough to leave my grandchildren, you don't spend your money or do things you love. Don't leave your kids any money, spend it all...leave them life insurance!

Make sure to cover basic expenses in your retirement plan

When working with a retirement planner one of the most important things to address is how you will comfortably cover the expenses you need to live out your retirement.

Most people focus on accumulation in pre-retirement years but most retirement planners don't focus on the equally important distribution phase once you stop working. The best way is to use an annuity whereby you convert a portion of your nest-egg to meet this need.

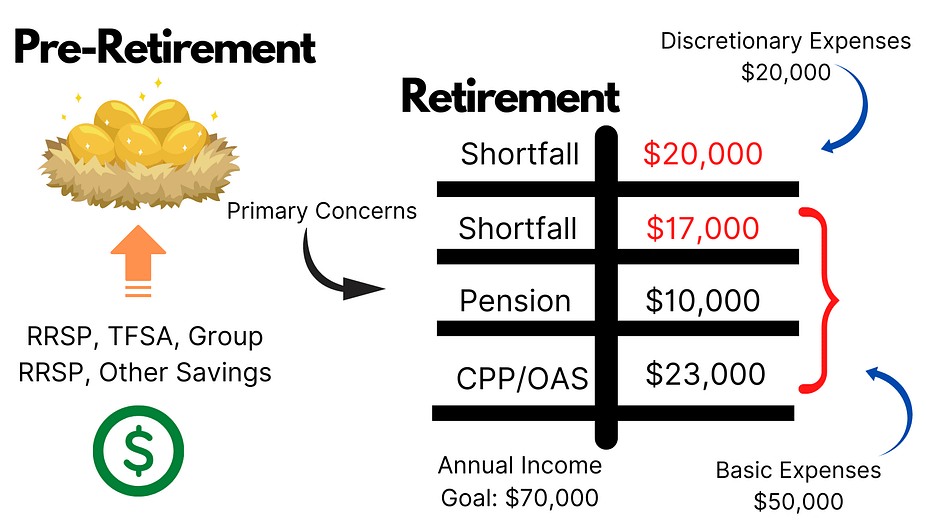

The image below shows what to consider and how to think about covering all aspects of your retirement plan.

By way of example, assume you determine that you require $70,000 in annual income to support your whole retirement. The example below gives you a high-level guide on how to calculate what you will need to cover in terms of shortfall so you don't run out of money.

When should I start collecting Canada Pension Plan (CPP) payments?

What to consider before taking CPP payments.

What is the ideal age to take CPP?

This is a common question retirement planners get from people in the mid 50's going to age 60. In general, you can start collecting CPP payments anywhere between your 60th birthday and 70th birthday. Some might consider taking CPP past age 70 but in reality there is no real benefit in doing so. You qualify for CPP as long as you made at least one payment after age 18. You can apply for the start of payments the month after you turn 59 years old OR up to one year in advance before you know you're going to take it.

CPP vs OAS?

Keep in mind that CPP and Old Age Security (OAS) are two separate payments you receive from the government. OAS is eligible from age 65 to age 70. The most important point is that if you apply for CPP at age 65 you aren't obliged to apply for OAS at the same time and the opposite is true. Each one is separate and you should apply as you see fit for your situation.

How much CPP payment can I expect to get?

The maximum you're allowed can for CPP in 2021 is $1,203 but on average you can expect a payment of about $688. It all depends on your situation. The best way to find out what you qualify for is to create an account or login to My Service Canada here to see your estimate of CPP.

Do I automatically start getting payments?

You need to apply as the government won't automatically start making payments. Because it's income that is taxable in your hands it's important to plan it out with your retirement planner to see how to tax efficiently apply it to your retirement income plan to avoid such things as OAS clawback.

Note: It's always important to determine what age works for you and to discuss with a retirement planner like Blue Alpha Wealth. The mistake many people make is basing this decision on what a friend or neighbor did. This is why it's important to understand why you should be taking it at certain ages depending on your situation.

Penalty for taking CPP before age 65?

If you decide to start collecting CPP before your 65th birthday, the amount that you will get will be reduced by 0.60% for every month that you take it early. For example, if you take CPP at age 60, your amount is effectively reduced by 36% (0.60% for 60 months).

For each month that you delay taking CPP after your 65th birthday, you get a 0.70% increase in your CPP payment! This is a 40% increase in your payment if you take it on your 70th birthday.

How much do I need to save for retirement?

Use the Rule of 72

The rule of 72 is a great way to calculate how much you need to save by the time you retire to ensure you enough for your retirement plan nest-egg. With inflation at 3% the value of money is chopped in half every 24 years. This means that as you work with a retirement planner keep inflation in mind as you build your portfolio.

How to Use the Rule of 72 to Calculate Your Retirement Number

Multiply your retirement number by 20 because your retirement will likely last 20-30 years. This ensures that you can spend your retirement income into perpetuity, whilst factoring inflation and confidence your nest-egg will not run out.

Let's Get Started! Fill Out the Form So We Can Get Back To You To Answer Your Retirement Planning Questions.

Will you run out of money in retirement?

Imagine looking down at your gas gauge and realizing you have a quarter tank of gas ![]() left and knowing you’re stuck on this road for the next 217km? You’ll probably turn off the A/C, open the windows, drive slower and sweat profusely. You probably won’t know if the sweat is due to the heat or your worry. The scenery and drive won’t be as beautiful anymore as you pay attention to the gas

left and knowing you’re stuck on this road for the next 217km? You’ll probably turn off the A/C, open the windows, drive slower and sweat profusely. You probably won’t know if the sweat is due to the heat or your worry. The scenery and drive won’t be as beautiful anymore as you pay attention to the gas ![]() gauge.

gauge.

That’s what running out money in retirement feels like. As a retirement planner we've seen that running out of money is not a particular day but the days, months and years you struggle and penny pinch ![]() before you actually run out of money. You won’t have time to enjoy retirement. Solution: use 20-25% of your nest egg or RRSP to buy some form of pension-like guaranteed lifetime retirement income like an annuity.

before you actually run out of money. You won’t have time to enjoy retirement. Solution: use 20-25% of your nest egg or RRSP to buy some form of pension-like guaranteed lifetime retirement income like an annuity.

The happiest people in retirement are those that have some form of guaranteed lifetime income (like a pension) to cover their basic expenses. They've removed real estate, stock market and inflation risk and can live comfortably. Read this article to learn more.

Key Retirement Planning Risks

5 Risks that could derail your retirement plan

Long Term Healthcare Risk in Retirement

Which Retirement Do You Want?

Retirement "a"

Independent Income

$100,000

Income with disabled spouse at home

$64,000

*Out of pocket expenses. Family and friends become informal caregivers to support you and your spouse.

Retirement A

Provides a great income and lifestyle for you and your spouse while everything is going well and you're living your best life...

But if one spouse needs care, part-time home care could easily cost $3,000 - $4,000 a month*

And what happens to your lifestyle as a couple, and that of the still independently healthy spouse? It's cut in half or more!

You can't make up the difference by taking more money from your RRSP or TFSA assets because this will put at risk the long term viability of your financial plan.

* 5-6 hours of home care 7 days a week or 8-hours of care 5 days a week based on $23/hour.

retirement "b"

Independent Income

$96,400

Income with disabled spouse at home

$103,800

*Long Term Homecare Assistance = $3,000/month, premiums waived while on claim.

Retirement B

Assumes this 55-60-year-old couple purchased basic, affordable long term homecare assistance insurance that costs $3,600 per year or $150/month each to cover both.**

If one spouse is disabled needing substantial assistance with 2 of the 6 activities of daily living, their policies' entire premiums are waived AND it provides $3,000/month in tax-free benefits to pay for care.

The premium costs a few hundred dollars a month, but the benefits if one spouse needs care nearly TRIPLE the available income versus a self-funded plan!

**Homecare assistance benefits and premiums provided as an example illustration only. Premiums vary and are based on age/gender.

Have you considered long term care insurance for your future healthcare needs in retirement?

Have You Covered Your Retirement Risks?

Market Risk

This is the risk that you lose your money and investments to adverse shocks in the stock or real estate market. What would you d if you depend on your investments and the market drops 20%, 40%? How long can you wait for it to recover?

Longevity Risk

This is the risk that you live too long and outlive your investments and retirement income. Longevity risk is a "multiplier" risk because it opens up the door to other risks the longer you live e.g. health, market risk, long term car etc. Especially if you're a couple, your life expectancy is longer.

Withdrawal Rate Risk

This is the risk that you withdraw from your investments faster than is sustainable in the long term. In the past the "rule of thumb" was to withdraw at 4%. That has changed as the economy and markets have changed. 4% may not be adequate for you and your life and if you take more you might run out of money quickly.

Order of Returns Risk

In retirement, you have no control over what years you get negative returns and what years you get positive returns. This is called “sequence of returns”.

The problem is those negative returns, especially if you’ve set a specific withdrawal rate for your retirement spending like 5%. Even if you average 10% in the first 10 years of your retirement, you don’t know when the negative returns will come. So at 5% withdrawal rate you run out of money fast.

Deflation Risk

This is the risk that the general price levels in Canada start falling—as opposed to inflation when prices rise. The risk to you is the contraction is the economy and lower demand leading to such things as asset bubbles that affect the value of your investments and ultimately the value of your retirement income.

Healthcare Risk

This is the risk that at some point in your life you will no longer be able to care for yourself without substantial assistance from somebody else. What usually ends up happening is that your family/friends take on this role of informal caregivers and have to put their lives on hold to do that. It's sudden and unexpected. In addition, it will require you to draw rapidly from your retirement savings which will deplete them much faster than your financial plan had bargained for. Long term care insurance can help mitigate this risk.

Do I need a retirement planner?

How does a retirement planner help?

Hi, I'm Carter, your independent financial advisor and certified retirement planner in helping you gain control over your financial life after work. You'll find I'm a good listener and willing to meet you where you are. I understand the anxiety that comes with retirement planning and managing your investments to help fund your retirement. I don't promise a silver bullet but if I can make an improvement on your current situation is that worth your while?