Disability Happens In A Flash

There's a reason there's more doctors and specialists in Canada than there are funeral homes. Disability insurance is paycheque protection.

Get disability insurance quotes to protect your income.

How Much Is Your Income Worth To You?

Disability insurance replaces your income and protects your lifestyle in the event you get sick or hurt.

Your income or salary provides for the lifestyle you currently live. What would happen if your income were cut down or stopped suddenly? How long could you go without your income?

Employer Workplace Disability Insurance Facts

How Does A Workplace Disability Insurance Plan Work?

If you're like most workers in Canada that work for small companies, your workplace Group Benefits likely do not have disability insurance. With good reason - it's expensive and the main reason why companies are forced to cancel the whole Group Benefits Plan.

If you have disability insurance through work, you might not realize that it's typically good for 4 months. After that you are basically taken off the plan with a requirement to return to work or find ANY suitable employment. In addition there is a cap on your benefits the higher your income.

Note: because in most cases your employer pays for the disability insurance, whatever benefits you will receive are before taxes. So your benefits pay 60% of your income. After tax it comes to about 40% of your gross income. Can you survive on that? For how long?

There's a reason why personal injury law is a lucrative business. A big portion of their income comes from fighting on behalf of employees who were denied long term disability (LTD) benefits or taken off claim from their workplace disability insurance.

When was the last time you read the long term disability (LTD) clauses of your employee benefits booklet?

Things to know when you make a disability claim through your employer group disability plan. Plans depend on your company booklet. Here are general guidelines.

The Problem

The Solution

The Global COVID-19 Pandemic Was A Loss of Income Dry Run

If you were anxious that you might lose a job due to the pandemic lockdowns you realized right away that it would mean a loss of income.

If you know someone who got COVID-19 and couldn't work for a while and lost income, this is exactly what it's like to have your income stop or be cut down immediately.

Disability Insurance By Profession

-

lawyer

-

it professional

-

business owner

-

executive

-

designer

-

sales professional

-

consultant

-

physician

-

construction

-

engineer

-

management

-

dentist

Professional working in a company

Your group employee disability insurance plan is exactly that...a plan that groups you together with every other employee or executive in the firm. It pays no respect to your own personal health, occupation and risks. It's only focused on the group as a whole such as the claims and number of people and how your company structures the plan. If you make typically more than $100,000 in income your benefit is capped so you're "penalized" for being a high earner. If you want coverage that will ensure you are covered for as long as you are disabled and unable to work, your workplace plan on average will pay for as long as 2 years.

Do you depend on commissions and bonuses for your income? Your group plan will cover $0 of this. If disability claims made within the group become too expensive for the life insurance company, it means your overall employee benefit costs will rise for the company. This will mean they choose to cancel the disability plan the next year leaving you with no coverage. The best way to avoid this and feel secure that your income is protected, is getting an individual disability insurance policy that won't change or be cancelled unless you do.

"Disability Won't Happen To Me!"

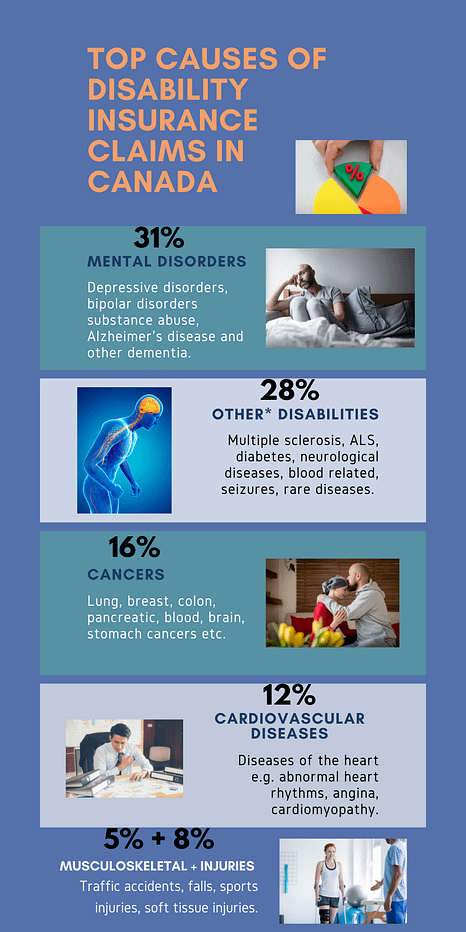

This is what most people picture when they think of a "disability". Because they don't encounter it in their life or those close to them it's hard to see that this is one part of a disability. Most disability insurance claims in Canada are illness and sickness related. Less than 10% are related to sports injuries or car accidents that lead to a wheelchair!

"Employee Benefits Will Cover Me!"

Nowadays most group plans don't have disability insurance. Why? Because it's expensive especially if a few people make long term disability claims that will cost the insurance company a lot of money to cover. Which would mean higher costs for the overall plan. Plus, if you do have a group plan with disability coverage most of them are paid for by the employer. What this means is that you pay taxes on your disability benefits so instead of getting 80% of your income you get 60%. The best solution is to top-up to get a private individual disability insurance plan. You can take it even if you leave your job.

"I have enough savings and can depend on my family or bank"

Real Examples of Causes of Disability By Age & Occupation

Many people think they’re “immune” from the possibility of becoming disabled. Here is a list of actual claims as submitted by insurance companies' disability insurance claim files. What could possibly prevent you from being able to work? Curious about what type of disability affects your profession? Get in touch with Blue Alpha Wealth.

Cause of Disability | Occupation | Age |

|---|---|---|

Multiple Trauma-Accident | President – Construction Company | 38 |

Cerebral Aneurysm | Psychiatrist | 55 |

Cancer of Lung | General Sales Manager | 48 |

Degenerative Disc Disease | Veterinarian | 54 |

Uncontrolled Diabetes | Lawyer | 31 |

Lumbar Laminectomies | Emergency Physician | 42 |

Coronary Artery Disease, Angina | Accountant | 55 |

Neurotic Depression | Insurance Broker | 35 |

Cervical and Lumbar Back Sprain | Advertising Consultant | 34 |

Severe Coronary Artery Disease | Ophthalmologist | 58 |

Cause of Disability | Occupation | Age |

|---|---|---|

Carcinoma Lung | Orthopaedic Surgeon | 60 |

Lou Gehrig’s Disease (ALS) | Dentist | 36 |

Multiple Sclerosis | Vice President | 58 |

Acute Myocardial Infarction | Owner / Manager | 45 |

Myocardial Infarction, Coronary Artery Disease | OB/Gyn | 62 |

Fracture, Elbow-Radial Head and Neck | General Surgeon | 55 |

Parkinson’s Disease | CPA | 62 |

Parkinson’s Disease | Vascular Surgeon | 59 |

Peripheral Myelopathy | Dentist | 30 |

Thoracic Outlet Syndrome | V.P. Finances | 50 |

Shouldn't I just buy Critical Illness Insurance?

Critical illness is a great benefit if you need a huge lumpsum immediately that's tax-free to help you recover from an illness like cancer or heart attack. That's the main difference: it's a lumpsum and will only cover you if you survive an illness. It won't pay you for an accident or mental disorder or back pain that causes you not to work.

Disability insurance will pay you for both injury and illness in the form of a monthly benefit for as long as you aren't able to work. It depends on your income. Critical illness insurance depends on how much you can afford to buy up to $2 million.

Critical illness will pay you a one-time, tax-free lumpsum e.g. $50,000. Disability insurance will pay you a monthly benefit e.g. $3,000 a month. $3,000 a month for 30 years is equivalent to $1,080,000! It all depends on how long you need the money for.

Disability Insurance vs. Critical Illness Insurance

Disability Insurance

Critical Illness

Conclusion:

It comes down to what you can afford not to lose when you become sick or hurt. If you can't lose your income for the next 5-30 years, then disability insurance is likely the best option. If you're not worried about future income and would prefer a cash lumpsum to help you recover from a major illness, then critical illness is suitable. Keep in mind critical illness will only pay you once and doesn't cover injury or accidents.

Ultimately, your budget will play a factor as well. You can buy unlimited amount of critical illness but with disability it will depend on what income you can justify and prove. Either way both are good options when you need them.

Get A Disability Insurance Quote

Disability happens to a family, a business. Not just an individual.

Disability Insurance FAQs

You can expect to pay 1- 4% of your current income or 2 - 6% of the monthly disability benefit amount you choose. Cheaper doesn't always mean better and the most important thing to pay attention to is policy definitions. In addition, your disability insurance cost depends on several factors including:

- Policy definitions such as whether the policy considers you disabled if you can’t work in any occupation, or if you can’t work in your occupation?

- Is your policy considered non-cancellable and guaranteed renewable, or can the insurance company raise the premium or cancel your policy at certain intervals like 5 years?

- The financial strength and ratings of the insurance company?

- Your gender, smoking status, height and weight

- Your financial information like bankruptcy

- Your occupation and the risks you have to take outside of work such as skydiving etc.

- Optional benefits added to the policy such as inflation protection or partial benefits

Disability insurance is like insurance for your ability to earn an income. It covers you if you can't work and earn an income in the event you get sick or hurt. You consult with your doctor of choosing and they recommend how long you need to be off and that will be the period you will get paid the benefit. Your benefit amount depends on your income and you need to be employed to be able to replace your income. You can claim multiple times if you get injured or sick multiple times over the life of your policy.

In general, your ability to earn a living is your most important asset as it funds your lifestyle. Disability insurance provides you with a percentage replacement of your income if for some reason your income is cut down or stops immediately due to an illness or injury and you can't work for a while. It is a foundational insurance that holds up everything else even your ability to pay your life insurance premiums.

Any type of disability insurance you have in place is good as long as it will pay you when you need it. The challenge of workplace disability insurance is that it's paid out before taxes which reduces your benefit at time of claim. So you typically end up with a 40% pay cut once you receive it. In addition, if you make over $100,000 a year you are covered up to a group maximum for most group plans. Disability insurance at work is beneficial if you make a relatively lower income. If you make bonuses or commissions as a major part of your income, workplace disability insurance doesn't cover that compensation.

It depends on the policy terms. Disability insurance will typically cover you for an injury or accident as standard. You will have to add an option for illness or sickness coverage. If you had a pre-existing condition stated in the policy at application, you will not be covered for that particular condition which is considered a policy exclusion. It's important to read the policy provisions to determine what is covered and what is not. Blue Alpha Wealth can walk you through and explain your specific policy provisions thoroughly.

Two main types of disability insurance in Canada are classified as short-term and long-term. Short-term disability insurance covers lost income for about three to four months while long-term disability insurance typically pays a portion of your lost income for anywhere from one year to your entire life. This is why it's important to buy your own long term disability insurance because after a while your workplace long term plan will stop paying and expect you to go back to work after two years.

You compare by looking at policy definitions and provisions such as the definition for what is considered a disability and when and how a claim will be paid. You also want to consider the financial strength and ability of the insurance company to pay. It's important to go through the contract language with an independent broker like Blue Alpha Wealth to ensure you get the right policy. Keep in mind that cheaper does not always mean better. The insurance company can potentially pay you millions over your life so both parties need to ensure they enter into a feasible agreement based on your health etc.

In most cases if you buy a private individual disability insurance policy, your benefits are tax-free as you would have used after-tax dollars to pay for your policy. If say for instance you get a policy through work, if your employer pays the premium you will be taxed on your benefits. If you pay the premium you won't be taxed. Always talk to your accountant for tax advice for your unique situation.

Yes you can. These are called guaranteed issue disability insurance policies. The drawback to these is that you will pay for the policy but at time of claim you will go through underwriting or medical exam to see if there are any major issues. The insurance company can deny a claim if they find something or an issue with your health that would cause them not to pay. It's always good to do medical underwriting prior to buying a policy so you know exactly what you're covered for, but it's not required.

This is the time that passes before the insurance company starts paying you your monthly benefit. It's like a deductible of time. It makes the cost of your policy affordable the longer you wait to receive benefits. You can have a 0 day, 15 day, 30 day or 90 day waiting or elimination period.

For example, if you have a 90 day wait period, the clock starts ticking after 91 days. So, from 91 days it might take another 30 days to process your claim such as the back and forth of getting paperwork from you like the claim form and your attending physicians notes on the injury or illness etc. and their recommendation. While it might seem long, in the long run it is better because it's always best to get it right and to lead to a successful disability insurance claim.

It depends on how long you are able to go without an income and can tap into your savings. Most policies are priced to have the sweet spot as a 90-day elimination period. The premium doubles by decreasing the waiting period to 30 days. In other words, the shorter you wait the sooner you'll get your benefits but it will cost slightly more in terms of your monthly premium cost.

In most cases individuals rely on savings to take them for 3 months. However, most people may not be able to afford going without an income for more than a month. Another option is to divide your benefit amount based on waiting periods. For example, if you require a $5,000 a month benefit you can divide it into two whereby you receive $2,500 after 30 days and the remaining $2,500 after 90 days to help reduce the cost.

This is a case whereby you have a known or unknown pre-existing condition that has a potential impact of a future disability. What this means is that the insurance company approves your application on the condition that they don't cover the pre-existing condition if it results in a future claim or leads to a claim. This exclusion could be temporary or permanent and if temporary the insurance company will let you know when the exclusion will be removed from your policy contract and under what circumstances.

It depends on the insurance company and the type and severity of the medical problems. The insurance company has three options:

- Charge you a higher premium for the policy

- Exclude the condition from the policy

- Decline insurance altogether

It's important to determine this prior to application in the event you want to take a dry-run before you apply. Critical illness insurance could be another option in the event your medical condition is more sickness related.

Group Long Term Disability Insurance:

- Benefits are taxable if your employer pays the premium.

- Benefits are based on a percentage of your base income or salary. Bonus and commissions are typically not covered.

- Benefits are typically reduced during a period of disability if you receive benefits from another source or work in a different occupation.

- More restrictive definitions within the policy (qualification for benefits may require you to be unable to work in ANY occupation).

- No rate guarantees.

- Partial disability may not be covered.

- Policy can be changed or canceled by the insurance company or your employer at any time.

- Policy is connected to the employer and generally not portable.

Individual Disability Insurance

- You receive benefits tax-free if you pay the premium.

- Quality plans will cover you in your own occupation/specialty.

- More liberal definitions within the policy to pay you more money in more claims scenarios.

- Higher monthly benefits.

- Benefits can increase with inflation.

- Rate guarantees to age 65 or for a lifetime.

- You own the policy and can take it with you to a new job or occupation (portability).