Registered Education Savings Plan.

Grow Your Children's Education Savings Tax-Free.

Save for your children's future education with a Registered Education Savings Plan (RESP).

Let us help you manage and maximize the investment and government grant benefits of an Registered Education Savings Plan in Canada.

Shelter your children's education savings from tax using an RESP.

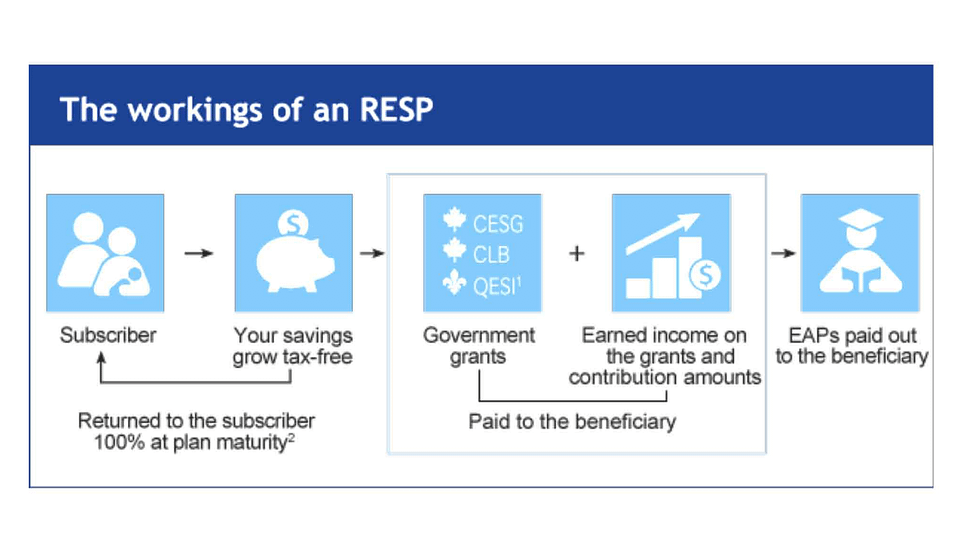

The twin benefits of a Registered Education Savings Plan are the tax sheltering of your savings as well as the "free" 20% Canada Education Savings Grants.

Registered Education Savings Plan Basics

RESPs are designed to provide a way for families to save for their children's education in a way that saves on taxes and provides an extra bonus or motivation. Working with Blue Alpha Wealth, we can help you understand the mechanics and rules of the Registered Education Savings Plan. We show you options for investing, when and how to withdraw as well as other bonuses available from investment companies.

You can setup an RESP for any individual (child, grandchild, nieces, nephews, friends) called a “beneficiary” i.e. the child or student to benefit from the plan. In order to qualify the beneficiary must have a social insurance number as there are tax benefits and grants that need to be accounted for. Apart from young children, an adult can name themselves as a beneficiary for an RESP. The only restriction is that an adult wouldn't qualify for the Canada Education Savings Grant based on age limits detailed below.

The most important consideration when opening up an RESP if you're not a child is that the benefits of government grants only apply to those under age of 18. In addition, your child has to be 15 and you have to open up the RESP account before end f that calendar year for them to qualify for the 20% government grant. This is why it's important to start saving early for your child's Registered Education Savings Plan.

At age 16 or 17, your contributions will only get the 20% CESG top-up if at least one of two conditions are met:

- At least $100 was contributed and not withdrawn from the RESP in at least four of the years prior to the end of the year the child turned 15.

- At least $2,000 was contributed and not withdrawn from the RESP before the end of the year they turned 15.

$50,000 is the lifetime limit per child across all RESP accounts you open, that can be contributed to a beneficiary’s RESPs. Similar to a TFSA, you will be required to pay tax in the amount of 1% per month on your share of the amount above $50,000 that is over-contributed until you withdraw it.

There is no advantage or disadvantage to how much of the $50,000 you contribute. This is because the government of Canada will only give you the CESG grant top-up for the first $2,500 each year you save, unless you are carrying forward unused contribution room. What most people will do is contribute the $2,500 or $208/month to get the maximum benefit yearly.

RESP contribution room, carry-forward rules

You can catch up on RESP contribution if you’ve fallen behind similar to the room you have in an RRSP or TFSA. This contribution room allows you $2,500 each year from the time the child is born. For example, if your child was born in 2020 and, because of all that was going on that year with the virus, you didn't get to opening up an account until 2022, you would be entitled to start with $5,000 worth of contribution room rather than having to start from $0 in 2022 when you opened the account.

There is a catch though...

Carry-forwards on CESG grant limits

Using the $5,000 room above, it's important to note that if you put all of it in it doesn't mean you will get all the grant money as would be the case in typical circumstances. In the case of carry forwards, the government will only give a maximum Canada Education Savings Grant of $1,000 in a given year. Using the 20% CESG amount for every $2,500 of your contributions, if you contribute more than $5,000 i.e. $7,500 ($2,500 for the current year + $5,000 carry-forward) you won’t receive grants for the overage over $5,000 as the two separate $2,500 contributions give you $500+$500 = $1,000 maximum grant allowed.

In addition, for carry-forwards , excess annual contributions do not carry forward to future years as credits.

The Canada Education Savings Grant (CESG) is a savings grant top-up available to Canadian students. It provides parents, grandparents or family friends who choose to invest in an RESP with grants of up to a maximum of $7,200 (or more) over the lifetime of the Registered Education Savings Plan. It's basically 'free' money or an incentive the government uses to help benefactors save for the education of children.

The Basic CESG program rewards you for contributing to your RESP on an annual basis. The government provides a grant of 20% of the amount you contribute in a year to a maximum of $500/year which is typically 20% on $2,500 contribution. The maximum Basic CESG grant amount you can receive over the lifetime of your RESP is $7,200.

For low income families i.e. those making less than $49,020 in net family income, the government offers even more whereby the government will add up to $100 after you invest your first $500 each year. In general, the maximum grant you can receive with the Additional CESG for families making less than $49,020 is $600.

Additional CESG is paid on the first $500 of annual contribution. Basic CESG is paid on first $2,500 of annual contribution. So, if you make more than $49,020 to $98,040, your maximum grant is $550. If you make over $98,040, the maximum CESG is $500.

Note: if you receive Additional CESG, the lifetime maximum of $7,200 still applies regardless.

When you work with the bank branch you are able to open an RESP. However, the biggest complaint we get from clients is that they would like better service and investment options. When you buy the bank RESP funds you can only invest in that banks product. So, if you bank with TD you can only access TD products. In addition, people complain about the returns. This is because bank employees have the role of having to deal with many people, so rather than manage your RESP investments by putting them into appropriate funds, they put it into conservative funds where you don't lose a lot of money but you don't make money as well. This is so they can get more clients.

When you work with Blue Alpha Wealth we work with you directly and help you understand and manage your funds so that you feel confident that they grow to meet the education funding needs of your children when they need it.

RESP plan providers like Heritage or CST are doing a noble thing of helping families save for their children's education. They make it easy for families to pool their funds with other families so as to try and get the biggest bang for their buck. However, by "grouping" your RESP contributions with the contributions of others you have some disadvantages.

- Group plans have costly administrative fees that erode your RESP values. These are taken off from the top before you invest.

- If you decide to move your account or work with an independent financial advisor the fees for redeeming your funds are steep.

- You don't have the same investment choices as if you setup your own individual account.

When you work with a financial advisor you create a custom plan that fits your situation and goals. You are not locked-in and you benefit from working one-on-one with a professional advisor.

There is no limit on the number of plans that an individual can have in their name. The total lifetime contribution limit of $50,000 still applies. It's important for the subscribers (parents, grandparents, family friends) of each plan to coordinate contributions to ensure that lifetime limits are not exceeded to avoid the 1% tax.

You can typically invest in stocks, bonds and investment funds. The key to remember is that you don't have to take too much risk investing in aggressive investments like cryptocurrency or silver bullet investments. Since you are getting the 20% CESG grant, consider that as an "investment gain" that reduces the need to "try knock it out the park" with investment returns.

You can contribute to your RESP for up to 31 years after the plan is opened. Following that, you have until the 35th anniversary date of the opening of the plan to use the funds before your RESP expires.

What happens to the investment funds after a plan expires?

If your plan expires with funds remaining, here’s what happens:

- The government contributions (e.g. from the Canada Education Savings Grant or Canada Learning Bond) will be returned to the government.

- Personal contributions will be returned to the plan subscriber (i.e. the person who opened the RESP)

- Income earned in the RESP (e.g. capital gains, interest) will be returned to you if all of the following are true:

- All beneficiaries of the plan are at least 21 years old and are not eligible for an Educational Assistance Payment (EAP);

- The subscriber is a Canadian resident; and

- The RESP was opened at least 10 years prior to it expiring.

If the above is true, the money is withdrawn as an Accumulated Income Payment, i.e. your child isn’t going to school and you want to take the income earned out of the RESP, which can carry a high tax penalty (marginal income tax rate, plus an additional 20%). If you don't prefer that burdensome option, you can transfer those funds to your RRSP provided you have RRSP contribution room.

You can open up an RESP plan as an individual plan i.e. one child or as a family plan if there are siblings or multiple beneficiaries. The nice thing about this is that if one child decides not to go to University or college, the funds can be used by the other beneficiaries.

The government grants in your RESP were provided with the understanding that those funds would be used for postsecondary education. When it’s time to withdraw, you’ll need to prove that your student has enrolled, and then you can proceed to withdraw the funds you need. Otherwise, you can deposit it into an RRSP as detailed above in the event the child chooses not to attend school.

need some help opening a resp?

How do I get a Social Insurance Number (SIN) card?

Anyone seeking to setup an RESP for a child and get CESG grants from the government of Canada, is required to have a valid Social Insurance Number as well as request one for the child beneficiary. It's not uncommon for a child not to have a SIN Number when people setup RESP plans. The best way is to apply before or as soon as you open your RESP but in the event you can't, you can setup an RESP account today with Blue Alpha Wealth.

However, by law, you have 18 months to apply for the SIN Number with the government from the day the Registered Educations Savings Plan is opened. To acquire a SIN, you can either apply online or complete a paper application. If you choose to do a paper application, return the completed application, along with required ORIGINAL documents by mail or in-person to any Service Canada Centre. Click on either button below with your option to get started:

Benefits of a Registered Education Savings Plan

Government Contributions

Get 'free' grants from the government as an incentive to save. For every $2,500 you get $500 or 20% for any amount.

Less Reliance On OSAP Loans

Rely less on OSAP loans for if you live in Ontario. It gives your child a head start and less burden when they graduate.

Plan Flexibility

If you open it as a family plan if one child chooses not to go to school, the other child can use. If not, transfer to an RRSP.

Tax Sheltered Investing

Grow your money tax-free until your child takes it out. When it's taxed it's at the child's tax rate. Get better investments.

Mechanics of a Registered Education Savings Plan.

Learn about some of the key rules and considerations for opening up an RESP plan for your child or grandchild. Investment types, withdrawal options.

What are the different types of RESPs.

You have a choice between individual, family and group RESPs. Blue Alpha Wealth works with families using individual and family RESPs. We typically don't recommend group Registered Education Savings Plans.

Start Planning Your RESP Today!

Get in touch with Blue Alpha Wealth. We'll help you plan and maximize your RESP options!

What are some alternatives to RESPs?

Registered Education Savings Plan is One Option

It's no secret that inflation and the cost of living is going up nearly every day for basic living expenses let alone paying for children's education many years from now. The government, in trying to incentivize families to save for future education costs by investing that money tax-free and getting a 20% grant on deposits, at least is attempting to reduce that burden. However, this may not be enough as the limit on contributions in registered education savings plans is $50,000 and market fluctuations cannot be fully depended upon to grow that. You may also not want to take too much risk. The two other options are using a Tax Free Savings Account (TFSA) and/or Children's Life Insurance in combination with your RESP. Before we discuss other RESP options it's important to get a sense of what the future education costs in Canada might look like. If your child wants to go to the US or overseas it will cost more.

$70,000 - Average cost of a 4-year university degree.

31 - 35 - Number of years contributions may be made after plan is set up.

$110,000 - Estimated cost of a 4-year degree by 2022.

Tax-Free Savings Account

With a maximum contribution amount of $50,000 over the lifetime of your child's RESP, you may consider using a TFSA to save tax-free to supplement your RESP savings. You can't open a TFSA for a minor below 18 years old but you can open one in your name as a secondary Tax Free Savings Account stipulated for your child's education. The nice thing about this is that it's tax-free. You can get "donations" from friends and family to put into the account on birthdays, special occasions etc. Together with the RESP, when your child turns 18, you can turn over the money to them and they can put it into their own TFSA and use towards their education. Learn more below about TFSAs. Imagine putting away $50,000 tax-free for 18 years in addition to the money you can put into an RESP and get government grants? The benefit will be tremendous!

Children's Life Insurance

The flexible way to prepare your children's financial future

Children's life insurance is probably one of the least understood types of life insurance. It's likely because the first thought that comes to mind is that the parents are buying life insurance on the child so they can benefit or profit from it. However, what you are really doing is buying time and taking advantage of your child's age to secure their future.

As a parent you likely bought life insurance for yourself to protect your children in the event you pass away prematurely. It was likely term life insurance that expires in 10 years or 25 years. You are buying it at age 30 to 40.

Imagine if your parents bought you life insurance at 5 years old and they only had to pay for it for 20 years then at age 20 they hand over the policy to you and you have it for life! People buy term life insurance because it's affordable at age 30 or 40 when they're starting out but it expires after 10 to 25 years. Plus, like car insurance you don't get anything back and don't build an asset.

The beauty of children's life insurance, like a TFSA, is that you can use it however you want. It provides for flexibility, whether for use to fund education or later in life to buy a house or invest in other ways. The other benefit is the low cost due to your child's age and unlike term life insurance, their policy never expires.

children's life insurance is to buy time and create an asset for your children for the future.

How Does Children's Life Insurance Work?

Children's life insurance is Participating Whole Life Insurance

Children's life insurance is a form of participating whole life insurance. Unlike term life insurance, it is "permanent" life insurance, meaning it lasts for the "whole life" of the policyholder, in this case the child. In most cases, like a mortgage, you pay or invest a sum for 20 years. As you are paying the value of the policy grows in value i.e. equity, which are called cash values.

For example if you have a 5 year old and start with a policy for $100,000, after 20 years you stop paying but the value of the policy after growth in equity or cash values is $84,632. That is 50% risk-free return in 20 years. If your child chooses not to touch the policy, after another 20 years at age 45, the value of their policy would be almost $165,000. See the example table below:

Age | Accumulated Cash Value | Life Insurance Value |

25 | $13,431 | $84,632 |

45 | $48,075 | $162,858 |

65 | $148,341 | $283,587 |

75 | $248,239 | $374,358 |

Sample illustration is based on a monthly contribution for a 5 year old female of $3.07 a day/$92.12 a month for twenty years. Cash and life insurance values are based on the current dividend interest rate of 6% - 7% from a life insurance company in Canada. The example above is strictly for illustration purposes.

FAQ About Life Insurance For Children

As young as two weeks old. This plan can be opened by a parent, grandparent, family friend, aunt, uncle, or legal guardian for a child as young as 14 days old. You can also open it for children over age of 18.

No, not at all! This is meant as a supplement to a Registered Education Savings Plan. This plan is meant to help you save more for your child if you feel that $50,000 maximum allowed for an RESP will not be enough to help fund you children's future education. Besides just assisting with education, it is used a general tool to help prepare your children financially for the future by building an asset.

Participating whole life insurance is a type of whole life insurance that combines guaranteed cash values (equity cash build-up) with tax-free annual dividends. There is insurance coverage and investment portion that grows tax-free throughout your child's entire life and which your child can use for their education and any financial need like a home down payment or other financial investments in life.

There is no minimum or maximum amount - it all depends on how much you seek to supplement your RESP and on your budget. Typically, you want to get an amount that you can easily afford and can maintain for the next 20 years. An average family typically contributes about $100 - $200 per month towards this plan.

Anyone can setup this plan for a child - family friends, parents, grandparents, aunts, uncles and legal guardians.

Unlike an RESP you do not need to register your child for a SIN number to open the plan up.

Life insurance for children is completely funded for your child's whole life, after 20 years of monthly or annual contributions.

Policy dividends are 'rewards' where the life insurance company pays into your child's policy a percentage of the life insurance companies profits. In other words, you participate in the profitability of the life insurance company. This is typically 6-7% annually. These policy dividends are used to buy more life insurance and add equity value to your policy.

There are no restrictions to what your child can use the funds for once you transfer the plan to them at age of majority or anytime after age 18. They can use the cash value for any financial need in life including education, down payment on their first home or for any financial need in life. There are no government claw backs as the money belongs to them once transferred in their name by you.

Yes, anyone can buy this participating whole life insurance plan. The reason why it's highly recommended for children is the age factor. The cost is much cheaper at younger ages than older. For example if the child were to by it at 5 years old for $50,000 it would cost $92.12 a month. Compare that to their parent buying it at age 40. It would cost $150 a month. It's a $60 difference which may not seem much. However, the difference is that the child has from age 5 to build a financial foundation and have life insurance for the rest of their life and more time to build cash values. In addition, it also dependes ont he health of the adult who buy it at age 40.

No. There are no taxes or fees when you transfer ownership of the life insurance policy to your child at your determined age.

Get in touch with us at Blue Alpha Wealth and we will run an illustration of different scenarios to show you for different budgets, timing and life insurance amounts. We would also show you how it complements your child's RESP if you are currently using it to save for their education.

give your child a head start

Your child has made it to university. now what?

What are the steps when it's time to make use of the funds from the Registered Education Savings Plan? How do you go about withdrawing the funds or if your child doesn't want to go to school?

How it Works

-

Step 2

-

Step 3

01

The Accumulation Phase

Savings and contributions made by you or family members grow tax-free with no tax on investment earnings as long as the funds stay in the plan. Lifetime maximum contributions per child is $50,000 and you are allowed a wide range of investment options.

Canada Learning Bond

The Canada Learning Bond is a one-time initial grant payment of $500 to an eligible beneficiary’s Registered Education Savings Plan. The Government will automatically add each year of eligibility, $100 until your child is 15 years old. Your eligibility comes down to net family income and number of children.

You have up until your child or beneficiary turns 18 to apply for the Canada Learning Bond. The earlier you apply, the sooner the grant money will start to grow in a RESP.

Your beneficiary is eligible for the CLB in the year they’re born or the year they became a Canadian resident. If you have not applied for the CLB right away, the Federal Government will still make payments for the previous years. All you need to do is to apply for the Canada Learning Bond.

The adjusted net family income levels and number of children required to qualify as of June 30, 2021 benefit year are:

| Number of children | Adjusted net family income for the 2020-2021 benefit year |

| 1 to 3 | Less than or equal to $47630 |

| 4 | Less than $53740 |

| 5 | Less than $59876 |

| 6 | Less than $66011 |

How do you apply for the Canada Learning Bond?

- If you are a parent and/or legal guardian and are contributing to your child’s RESP, download form HRSDE 0093 E (The original form must be forwarded to the RESP promoter).

- If you are a grandparent, aunt, uncle or non-relative and are contributing to a child’s RESP, download form SDE 0093 E – Annex B (The original form must be forwarded to the RESP promoter).

- Note that this form must accompany the main form SDE 0093 E.

Ready to setup an RESP with Blue alpha wealth?

Let's have a conversation so we know your goals and help you map out a plan to ensure your registered education savings plan gives you all you desire for your kids.