Get Health Insurance Quotes.

Self-Employed Health Benefits Canada.

As a self-employed person you're not entitled to health, dental & disability insurance like an employee with group benefits. You need private health insurance.

Self-Employed Health Insurance Benefits Options.

Being self-employed we help you protect your health and income without having to pay too much for health insurance!

Get Health Insurance & Dental Insurance Quotes

What Type of Health Insurance Coverage Are You Looking For?

Get the best private health insurance in canada.

Being self-employed like you are, you're not always entitled to receive the same types of benefits as an employee working in a company. Because of that, if you need emergency health care or if you get sick or injured and can't work, your income could stop or you have to pay a high cost out of pocket.

Blue Alpha Wealth's private health insurance options are well suited for individuals who are self-employed, entrepreneurs, independent professionals, contractors, work on a commission basis or anyone seeking health benefits not covered by a company group plan.

Our Health Insurance Solutions:

Limitations of Provincial Health Insurance Plans

Provincial insurance plans do play a major role in helping cover some essential and necessary healthcare requirements, however, they contain a number of limitations when it comes to overall coverage. Here are some of the limitations of Provincial health insurance plans:

Learn More About Self-Employed Health Insurance Options.

Self-Employed Disability Insurance

How Long Can You Afford To Go Without Your Income or Paycheque?

Take away the income block and the whole structure falls apart!

Are You Financially Prepared for A Disability?

Sources of Money | The Problem |

|---|---|

Savings | If you save 5% of your income each year, six months of total disability could wipe out 10 years of savings. |

Bank Loan | Which financial institution will lend you money if you are disabled and not able to work? |

Spouses Income | Can one person be a spouse, parent, private nurse and work at the same time? |

Liquidate Assets | Can you get a fair market price when you are forced to liquidate? |

”a complete health insurance plan includes some form of disability insurance to replace your income if you can't work. ”

Self-Employed disability insurance replaces your income and protects your lifestyle in the event you get sick or hurt. It also ensures you have a business to come back to when you recover. It's essential to your health insurance portfolio!

Your income or salary provides for the lifestyle you currently live. What would happen if your income were cut down or stopped suddenly? How long could you go without your income?

Get A Self-Employed Disability Insurance Quote.

FAQ About Self-Employed Disability Insurance

You can expect to pay 1-4% of your current income or 2-6% of the monthly disability benefit amount you choose. Cheaper doesn't always mean better and the most important thing to pay attention to is policy definitions. In addition, your disability insurance cost depends on several factors including:

- Policy definitions such as whether the policy considers you disabled if you can’t work in any occupation, or if you can’t work in your occupation?

- Is your considered policy non-cancellable and guaranteed renewable, or can the insurance company raise the premium or cancel your policy at certain intervals like 5 years?

- The financial strength ratings of the insurance company?

- Your gender, smoking status, height, weight

- Your financial information like bankruptcy

- Your occupation and the risks you have to take outside of work such as skydiving etc.

- Optional benefits added to the policy such as inflation protection or partial benefits

Disability insurance is like insurance for your ability to earn an income. It covers you if you can't work and earn an income if you get sick or hurt. You consult with your doctor and they recommend how long you need to be off and that will be the period you will get paid the benefit. Your benefit amount depends on your income and you need to be employed to be able to replace your income. You can claim multiple times if you get injured or sick multiple times over the life of your policy.

In general, your ability to earn a living is your most important asset as if funds your lifestyle. Disability insurance provides you with a percentage replacement of your income if for some reason your income is cut down or stops immediately due to an illness or injury and you can't work for a while. It is a foundational insurance that holds up everything else.

Any type of disability insurance you have in place is good as long as it will pay you when you need it. The challenge of workplace disability insurance is that it it before taxes when you get paid a benefit. So you typically end up with a 40% pay cut that will be taxed once you receive it. In addition, if you make over $100,000 a year you are covered up to a maximum for most group plans. Disability insurance at work is beneficial if you make a low income. If you make bonuses or commissions as a major part of your income, workplace disability insurance doesn't cover.

It depends on the policy terms. Disability will typically cover you for an injury or accident as standard. You will have to add an option for illness or sickness coverage. If you had a pre-existing condition stated in the policy at application, you will not be covered for that and it's considered an exclusion. It's important to read the policy provisions to determine what is covered and what is not. Blue Alpha Wealth can walk you through and explain the policy provisions thoroughly.

Two main types of disability insurance in Canada are short-term disability insurance and long-term disability insurance. Short-term disability insurance covers lost income for about three to four months while long-term disability insurance typically pays a portion of your lost income for anywhere from one year to your entire life. This is why it's important to buy your own long term disability insurance because after a while your workplace long term plan will stop paying and expect you to go back to work.

You compare by looking at policy definitions such as definition for what is considered a disability and when and how they will pay. You also want to consider the financial strength and ability of the insurance company to pay. It's important to go through the contract language with an independent broker like Blue Alpha Wealth to ensure you get the right policy.

In most cases if you buy a private individual disability insurance policy, your benefits are tax-free as you have used after-tax dollars to pay for your policy. If say for instance you get a policy through work, if your employer pays the premium you will be taxed on your benefits. If you pay the premium you won't be taxed. Always talk to your accountant for tax advice for your unique situation.

Yes you can. These are called guaranteed issue disability insurance policies. The drawback to these is that you will pay for the policy but at time of claim you will go through underwriting or medical exam to see if there is any issues. The insurance company can deny a claim if they find something or an issue wit your health that would cause them not to pay. It's always good to do medical underwriting prior to buying a policy so you know exactly what you're covered for.

This is the time that passes before the insurance company starts paying you your monthly benefit. it's like a deductible of time. It makes the cost of your policy cheaper the longer you wait to receive benefits. You can have a 0 day, 15 day, 30 day or 90 day waiting or elimination period.

It depends on how long you are able to go without an income and can tap into your savings. Most policies are priced to have the sweet spot as a 90-day elimination period. The premium doubles by decreasing the waiting period to 30 days.

This is a case whereby you have a pre-existing condition and at time of application the insurance company approves your application on the condition that they don't cover the pre-existing condition if it's necessary not to. This exclusion could be temporary or permanent and if temporary the insurance company will let you know when the exclusion will come off and under what circumstances.

It depends on the insurance company and the type and severity of the medical problems. The insurance company has three options:

- Charge you a higher premium for the policy

- Exclude the condition from the policy

- Decline insurance altogether

It's important to determine this prior to application in the event you want to take a dry-run before you apply.

Group Long Term Disability Insurance

- Benefits are taxable if your employer pays the premium

- Benefits based on a percentage of base income. Bonus and commissions are typically not covered

- Benefits typically reduced during a period of disability if you receive benefits from another source or work in a different occupation

- More restrictive definitions within the policy (qualification for benefits may require you to be unable to work in ANY occupation)

- No rate guarantees

- Partial disability may not be covered

- Policy can be changed or canceled by the insurance company or your employer at any time

- Policy is connected to the employer and generally not portable

Individual Disability Insurance

- You receive benefits tax-free if you pay the premium

- Quality plans will cover you in your own occupation/specialty

- More liberal definitions within the policy to pay you more money in more claims scenarios

- Higher monthly benefits

- Benefits can increase with inflation

- Rate guarantees to age 65 or for a lifetime

- You own the policy and can take it with you to a new job or occupation (portability)

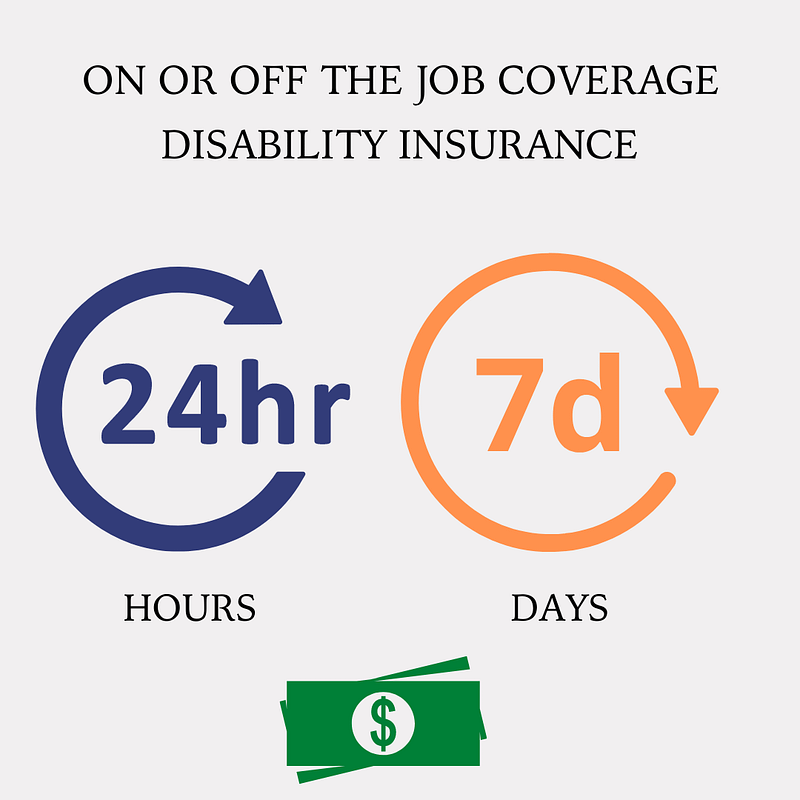

Get Full Protection of Your Income. WSIB (Workers Comp.) Will Only Cover You For On The Job Claims. WSIB IS Unsafe Health Insurance.

Features of Self-Employed Disability Insurance

Get paid from Day 1

Benefits payable from Day 1 of a claim.

Tax-Free benefits

Pay no taxes on your benefits.

Fast claims process

Benefits are usually paid within 7 days of claim.

No integration of benefits

Get paid on top of other benefits you may claim.

Comprehensive coverage

Back injuries, nervous disorders and soft tissue.

Injury & Illness Plans

Coverage for accidents, injury and illnesses.

Disability happens to a family, a business. Not just an individual.

Real Examples of Causes of Disability By Age & Occupation

Many people think they’re “immune” from the possibility of becoming disabled. Here is a list of actual claims as submitted by health insurance companies' disability insurance claim files. What could possibly prevent you from being able to work? Curious about what type of disability affects your profession? Get in touch with Blue Alpha Wealth.

Cause of Disability | Occupation | Age |

|---|---|---|

Multiple Trauma-Accident | President – Construction Company | 38 |

Cerebral Aneurysm | Psychiatrist | 55 |

Cancer of Lung | General Sales Manager | 48 |

Degenerative Disc Disease | Veterinarian | 54 |

Uncontrolled Diabetes | Lawyer | 31 |

Lumbar Laminectomies | Emergency Physician | 42 |

Coronary Artery Disease, Angina | Accountant | 55 |

Neurotic Depression | Insurance Broker | 35 |

Cervical and Lumbar Back Sprain | Advertising Consultant | 34 |

Severe Coronary Artery Disease | Ophthalmologist | 58 |

Cause of Disability | Occupation | Age |

|---|---|---|

Carcinoma Lung | Orthopaedic Surgeon | 60 |

Lou Gehrig’s Disease (ALS) | Dentist | 36 |

Multiple Sclerosis | Vice President | 58 |

Acute Myocardial Infarction | Owner / Manager | 45 |

Myocardial Infarction, Coronary Artery Disease | OB/Gyn | 62 |

Fracture, Elbow-Radial Head and Neck | General Surgeon | 55 |

Parkinson’s Disease | CPA | 62 |

Parkinson’s Disease | Vascular Surgeon | 59 |

Peripheral Myelopathy | Dentist | 30 |

Thoracic Outlet Syndrome | V.P. Finances | 50 |

Business Overhead Expense Disability Health Insurance

Cover Your Business Expenses If You Can't Work.

As the owner of your business, in most cases nothing works if you don't work. In addition, the last thing you want is to not to be able to come back to your business once you recover from an injury or sickness. Business overhead expense is a type health insurance helps your business meet its ongoing expenses if you or a co-owner can’t work due to a disability. This includes paying employee wages and covering the monthly rent dues.

Running Your Business

Pay salaries to retain valuable employees and keep your business running

Paying For Fixed Expenses

Cover ongoing fixed expenses such as rent, property taxes and utilities.

Business Overhead Expense Plan Features

Frequently Asked Questions About Business Overhead Insurance

Business overhead expense insurance is an expense reimbursement policy that covers the fixed monthly overhead expenses required to keep a business running until the return of the insured owner, after a period of disability. This allows business operations to continue until the insured owner either returns to work or makes a decision regarding the future of the business.

Basically anyone self-employed with fixed business obligations. Business overhead expense insurance is designed for principals of closely held businesses or practices and owners of small businesses. It is most vital for businesses and practices in which the owner's ability to generate income makes the difference between the office being open or closed for business—for example, contractors, physicians, lawyers, accountants, engineers and others.

Yes. Benefits will not be paid for disability if the disability is due to:

- An act or accident of war, whether declared or undeclared;

- Normal pregnancy or childbirth (however, disabling complications of either of these are covered)

Business overhead expense policy can be maintained until you (or another insured co-owner) reaches age 65. After age 65, the policy is conditionally renewable while you are employed full-time (minimum of 30 hours per week) and responsible for the expenses of maintaining your office or business. Rates and benefit periods are subject to change after age 65. You may continue the policy for the total disability benefit up to age 75. After age 75, your total disability benefit will be reduced by 50%.

Self-Employed Health Insurance Options Canada

Registered Therapists

Vision Care

Accidental Dental

Ambulance Transport

Hospital Stays

Hearing Aids

Travel

Home Support Service

Medical Services

What Type of Health Insurance Coverage Are You Looking For?

Get the most out of your health insurance benefits options with Blue Alpha Wealth.

Choose from a variety of extended health benefits to enhance your health care coverage.