Portfolio Diversification and Stability with Private Markets

Alternative Investments in Canada

Enhance Your Returns. Diversify Your Risk. Supplement Your Income

Discover the potential of private markets using Alternative Investments.

Enhance your investment returns with less market risk & volatility

Video courtesy of Ninepoint Partners

WHY PRIVATE MARKETS

Alternative Investments help diversify your portfolio beyond stocks and bonds

Stocks and bonds will always be a core part of any well diversified portfolio. We do believe, however, that private market alternative investments are now a fundamental part of a portfolio in 2022 and beyond. What you get is performance that is non-correlated and differentiated from stock market and fixed income bond markets.

3 Benefits of Alternative Investments.

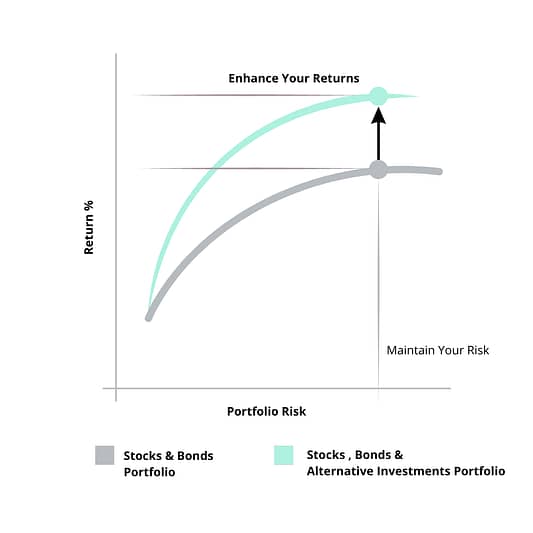

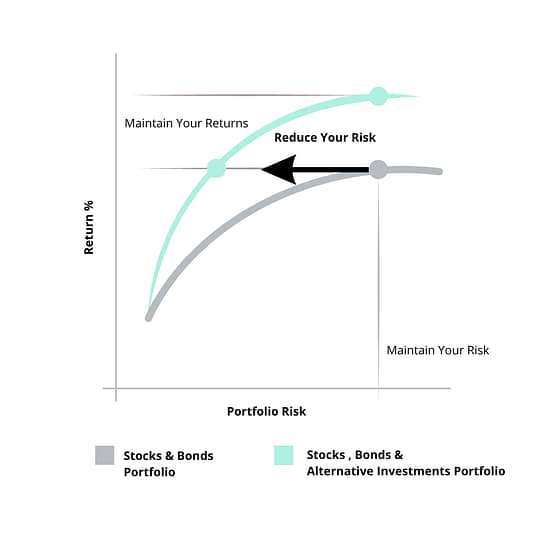

Create a more Efficient Investment Portfolio

Enhance Your Returns

Reduce your risk

For illustrative purposes only.

Invest a portion of your RRSP, TFSA and Non-Registered accounts in private market alternatives to provide greater stability & returns to your portfolio.

let's get started!

Get Started with Alternative Investing

Supplement your portfolio of GICs, stocks and bonds with up to 30% private market alternatives.

Is Your Current Portfolio Two-Dimensional?

Gaining seamless access to top-tier alternatives really levels the playing field for you as an investor. You can now compete with the most resource-rich hedge funds and institutional money management firms and build your portfolio in all market conditions.

Enhance Your Returns

Return enhancement strategies seek to deliver a positive return regardless of the broader market direction, or to access a distinctive return stream.

Diversify Your Risk

Risk diversification strategies tend to have low sensitivity to investments such as stocks and bonds and may target a lower level of risk than is associated with a particular asset class.

Supplement Your Income

In periods of persistent volatility alternative sources of income provide higher yields than traditional investments by seeking income from a broader opportunity set than bonds and GICs.

learn more

Asset Classes for any investment objective

I am looking for:

-

balanced

-

growth

-

tax deductions

Real Estate

Invest in income-producing commercial real estate properties like office buildings and shopping malls, or residential apartment buildings. Designed to provide a regular stream of distributions. To maintain these payments, goal is to invest primarily in a diversified portfolio of income producing properties.

Mortgage Investments

A mortgage investment corporation (MIC) like the RiverRock MIC is a pool of mortgages offered to investors as a security. The security is backed by mortgages which are secured against the real property mortgaged and it provides investors with an income stream by way of dividends. MICs are flow-through investment vehicles and must distribute 100% of net income before tax to shareholders. The dividends distributed by a MIC to its shareholders are taxed as interest income, in the hands of the shareholder. MICs may also flow capital gains to its shareholders.

Private Debt

Provide access to senior secured convertible asset based loans to public North American small cap companies with a focus on generating superior risk-adjusted returns and capital protection. Capital Protection fully supported by sufficient collateral and senior liens on critical assets of the borrower with a preference for self liquidating collateral. Equity Upside & Downside Protection by participating on upside to growing industries in rising markets and protecting your principal and receiving interest on loans in falling markets.

Short Term Notes

Short Term Notes offer you the opportunity to earn interest typically over the course of a 120 or 180 day term, similar to a short term GIC from that perspective. An additional feature is that you receive monthly interest payments at an annualized interest rate and your principal at the note’s maturity.

Structured Notes

A structured note is a type of bond in which an issuer borrows money from investors with the promise to repay all of the principal at maturity. The typical term for a structured note is five to seven years, sometimes two years, with the interest payment usually made once at maturity. Interest payment is based on an underlying asset's performance over the term of the note and is variable. If the underlying asset's performance is negative it is possible that no variable interest payment will be made.

In some cases, the interest payment may exceed the return that could be achieved from direct investment in the underlying asset. In others, an underperforming asset may produce no return at maturity, despite the potential for a positive return if the investor had invested directly in the equity-linked portion of the investment.

Information Request Form

BLUE ALPHA WEALTH

Alternative Investing in Canada

Tell us about yourself. We'll get back to you!

Download your FREE PDF White Paper to learn more about Alt investments.

Is Alternative Investing For You? Get a FREE PDF copy of "Alternative Investing 101" and learn about the easy to understand foundational concepts.

Investor Considerations - Do You Qualify?

Alt Investment Qualification Criteria

The private markets exist to provide small private issuers with a cost-effective and efficient market to raise capital. As a result, these private issuers are not subject to the requirements of the reporting issuer regime; they are less transparent; they are subject to less oversight by the regulators; and they provide less protection for investors with respect to statutory rights and disclosure.

This makes most alternative investments higher risk and not appropriate for most investors. Therefore, under the exempt market regime, only certain investors, namely those with more sophistication and means to withstand loss, are eligible to invest in exempt securities.

In general to qualify you have to be a high income earner or have substantial liquid assets. Get in touch with us to discuss if you qualify and see if alternative investments are suitable for your portfolio.

Video courtesy of Ninepoint Partners