How to Invest in Canada in 2024

Published December 20, 2023

Learn how to invest in Canada by following these 4 steps and keeping in mind which type of investments you choose and which type of investment account you use.

With all the market volatility, uncertainty and expectation of a recession, and the stock market getting a surprise boost from Artificial Intelligence in 2023, it's easy to understand why many Canadians are curious about how to invest their money in 2024. We were expecting a recession but that Do you continue to put your money into the tech darlings and "Magnificent 7" (Apple; Microsoft; Alphabet; Amazon; Meta; Nvidia; Tesla) that are driving the future economy or maybe cryptocurrency and investments related to the green revolution like electric vehicles and the 2035 mandate in Canada.

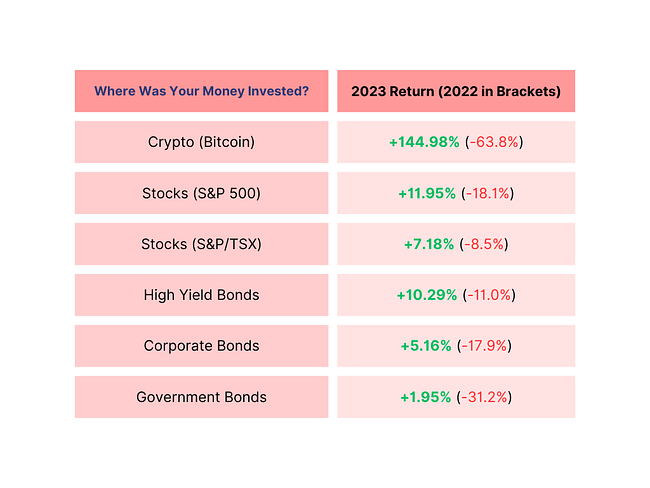

Compare how to invest in 2024 with how you performed in 2023 depending on what you held in your investment portfolio:

Steps on How To Invest

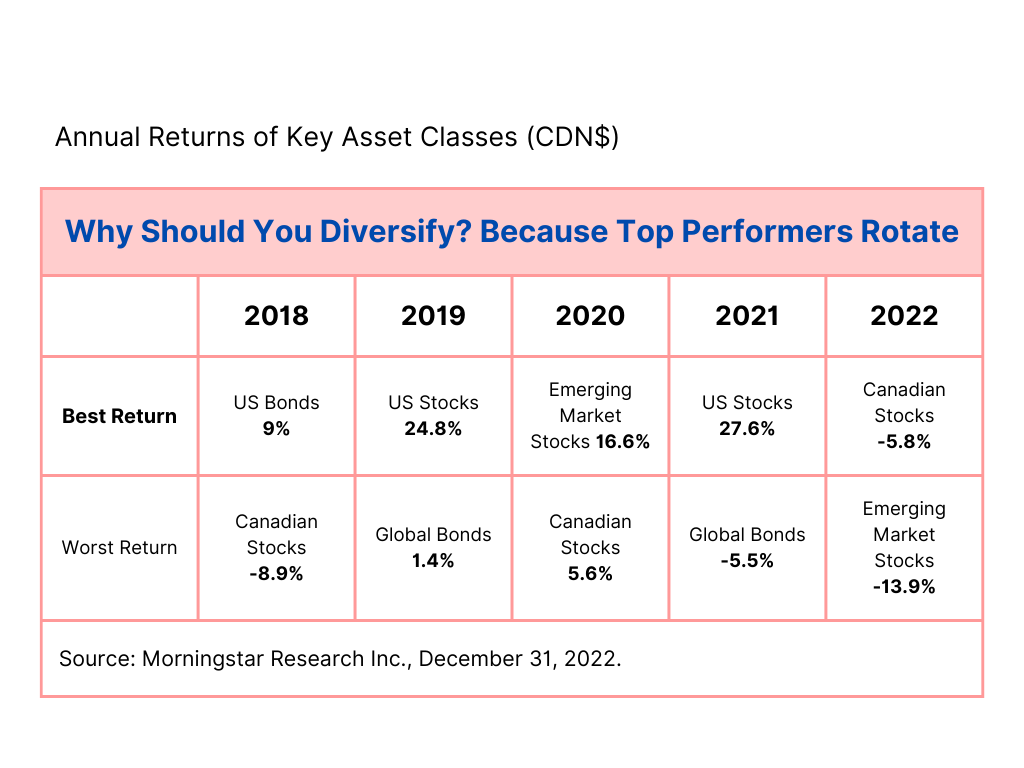

91.5% of Returns Come from Diversification

Financial news and media are helpful to keep track of what's going on in the markets and the economy to help you understand how that impacts your portfolio. The trouble is, as humans we are emotional beings and make emotional decisions particularly when it comes to investing. These news outlets and media focus on current events and sensationalism rather then help you learn how to invest. While we may make a logical decision about our long term investment plan, we quickly break that up with the slightest volatility and usually upending our plan. Rather than make constant changes it's better to allocate proportionately in a diversified way as this is where the bulk of your returns will come from...91.5% of the time.

Perfect Planning is Better than Perfect Investments

The reality nowadays is that everything about how to invest in Canada can be Googled and researched. The other reality is that not all information is accurate or useful and this leads to confusion and frustration for most investors. On the other hand, we could present to you an investment that you can Google and find 10 reasons why it's bad and these reasons could be legitimate. What's more important is whether you have a financial plan that addresses your specific objectives and use the investments as solutions that are imperfect but helpful.

Know What You Own & Why You Own It

Do you own crypto assets? Do you know how to invest in such a way that you have a diversified portfolio that may benefit from Bitcoin for example? Perhaps you invest heavily in oil and gas since Canada and the TSX are heavily represented by energy and materials companies. Or perhaps you hold a lot of interest-bearing investments like GICs outside of your RRSP or TFSA. Either way it's important to know why you own these and the tax implications.

Work With a Financial Advisor

Most people are able to make investment decisions and choose investments without the help of a financial advisor like Blue Alpha Wealth. The trouble is most people have careers and other conflicting priorities that require their time. Which is why working with a financial advisor to help delegate these decisions and determine for you how to invest your savings is one way to ensure the success of your investment planning.

Investment Allocation - Types of Investments in Canada

Equity Stocks - individual company securities where you buy a small stake in a public company listed on a stock exchange.

Bonds - an interest-bearing security where you 'lend' money to a company or government with the promise of receiving a guaranteed percentage return in the future.

Guaranteed Investment Certificates (GICs) - term deposits that allow you to 'lend' money to a bank or financial institution in the exchange for a guaranteed percentage return after a certain period like a year.

Mutual Funds - a basket of pooled investments that offer diversification and access to mainstream investors who may not be able to directly purchase individual bonds or equities.

Exchange Traded Funds (ETFs) - a pooled type of security that tracks a particular exchange like the Toronto Stock Exchange and allow for more passive type investing.

Segregated Funds - a type of mutual fund that is offered by life insurance companies that offers guarantees on your capital as well as an 'insurance blanket' for your beneficiaries when you die.

When it comes to choosing investments a lot depends on your objectives such as saving for buying a house or long term retirement planning. You may choose to be conservative for one and more aggressive for the other. You may also decide what type of investment to buy in Canada based on whether you have the skill and time to make those decisions or an investment advisor might guide you in choosing those investments. Ultimately, the type of investment you choose when you decide how to invest in Canada will depend on how you plan.

Note: most investment types can be accessed through a direct investing brokerage and financial institution. Some other investment types like alternative investments would require to work with a licensed investment broker.

Investment Location - Types of Investment Accounts in Canada

When it comes to choosing types of investment accounts (location) to buy your investments in Canada, you typically have two choices. Registered Accounts that give you tax benefits and maximum contribution room such as the Registered Retirement Savings Plan (RRSP). The other type is Non-Registered Accounts that don't have typical tax deferral benefits but have no contribution maximums. Below is a comparison of the different types of investment accounts available to you in Canada where you can invest your money.

Buy your first home or help your children or grandchildren save faster!

The First Home Savings Account (FHSA) is a new type of registered savings plan established in 2022. As a hybrid of the RRSP and TFSA, it can help you save for your first home, tax-free.

What is the difference between an RRSP, LIRA, Non-Registered and TFSA Account?

RRSP (Registered Retirement Savings Plan) | LIRA (Locked-In Retirement Account) | Non-Registered (Open Cash Account) | TFSA (Tax-Free Savings Account) | |

|---|---|---|---|---|

What type of investment account is it? | Retirement savings account | Retirement savings account | Investment savings account | Investment savings account |

How do I open an account? | - Must have an income - Must be a Canadian resident with a SIN number - Must be 71 years or younger | Must have had an employee pension plan from a previous employer | - Must be a Canadian resident - Must have a valid SIN number - Open with a self-directed brokerage or financial advisor | - Must be a Canadian resident with a SIN number - Must be at least 18 years or older - Can open with most financial institutions |

How do I taxes affect this account? | - Money won't be taxed until it's withdrawn - Withholding tax rates: Up to $5,000 - 10% $5,001-$15,000 - 20% $15,001 & over - 30% - Tax deductible to limit and marginal tax rate | Money won't be taxed until withdrawn | - Money taxed each year in which you have investment gain - Capital gains, interest and dividend income taxed at different rates with interest being taxed the highest | - Money won't be taxed when withdrawn - No taxes on investment gains |

Are there contribution limits? | - Contribution limits set every year and typically 18% of income - Contribution limit for 2023 tax year is $30,780 with contribution deadline being February 29, 2024 | - Cannot make contributions into this type of investment account - You can make a non-taxed transfer from a former employer pension or another locked-in account | No contribution limits | - Contribution amount changes yearly. It was $6,500 in 2023 - $7,000 maximum contribution for 2024 new money - You can also contribute for unused room from 2009 or room created due to previous years withdrawals |

When can I withdraw my money? | - Can make withdrawals anytime before 71 but subject to withholding taxes - Must make a full withdrawal in the calendar year you turn 71 to start taking minimum (Registered Retirement Income Fund) RRIF payments | - Anytime after age 55. Can make a withdrawal before age 55 but only for financial hardship reasons - After 55 years of age account turns into a Retirement Income Fund | Anytime | Anytime |

What happens to the account when I retire? | Must be converted into a Registered Retirement Income Fund by the end of the year that you turn 71 | Converted into a Registered Retirement Income Fund by the end of the year that you turn 71 | Continue to make contributions to the account | Continue to make contributions to the account |

The Story

There are two opposing forces when it comes to how to invest your money. Many investors typically have a collection of investments or investment funds but no real strategy. When it comes to thinking about how to invest, most of what we do at Blue Alpha Wealth is help investors organize what they're currently doing so they feel secure and in control of their financial investing goals. Here is the main problem you might be facing as an investor and the solution:

The Problem

Most people mistake investing with trading. What we mean is that, most people set up their portfolio for long term investing but their day-to-day behavior is as though they were trading. People also neglect the impact of taxes.

The Solution

Create an investing strategy that removes emotions and reacting to volatility or changes. Understand if your investing objective is long term or short term. Lastly, consider taxes and where you allocate your investments

Frequently Asked Questions (FAQ) About How to Invest in Canada

The most practical reason to invest is to grow the future value of your money so it is not eroded by the effects of long term inflation. Because the interest rates offered by banks tend to be low or lower than the inflation rate, people look for higher returns by looking for different types of investments that can grow the value of their money.

In general, as soon as possible. The younger the better as it gives you time to learn and understand how investing works. Depending on whether you are investing for retirement, the sooner the better so you don't have to take a lot of risk. You should also invest as you able to financially and can take on the risk of investing.

No, you don't have to work with an investment advisor like Blue Alpha Wealth in Canada. You can do it yourself as long as you're comfortable doing it and managing your investments. Most people seek out an advisor for their investments because of a lack of time to research adequately and choose the right investments. Because they lack the skill for these decisions they prefer to delegate it to a financial advisor. Another added benefit of working with a financial advisor is that we can help you see your overall financial picture and help you use your investments appropriately to fund your goals.

In general you should always stay invested and not try and time the market. You may also consider investing based on what future financial objectives you have that will determine how long you need to invest your money for.

A lot depends on your circumstances i.e. your income, the capital you have available, your risk tolerance and your time horizon. If you have never invested in an RRSP you can invest the amount of unused contribution room you have available as shown on your Notice of Assessment for your recent tax filing. If on the other hand you have never invested in a Tax-Free Savings Account (TFSA), you can invest a maximum of $95,000. Ultimately, you should invest an amount you're comfortable with that is aligned with your stated financial objectives that are short term or long term and consider if you need the money in the near future or for retirement.

With a lot of talk about fees by companies like Questrade and Wealthsimple it's easy to think that there are no fees for investing. These two companies may offer low fees but it depends if you're just looking to invest with no guidance. Many people prefer guidance and the help of a financiala dvisor to help them manage their investments to help with their overall financial planning. This requires skill and stewradship and the fees help to compensate for this. The investments you buy in mutual funds require portfolio managers and research analysts to determine the best investments to put in that fund to benefit you. These people also need to be compensated. Fortunately, you can choose if it's worth it to you to pay for these services and advice and as such you can do it yourself without the guidance. Most people can manage their investments by themselves but as life gets busy and they lack the time and energy to do the necessary research to manage their portfolio, they hire an investment manager to do this on their behalf.

As a rule, the more return you require the riskier the investments you likely have to buy. The more conservative you are the less risk you should take with the types o investments you buy. In general, your risk level should also depend on your life stage i.e. younger vs older and your capacity to take on that risk i.e. substantial assets and high income and your investment not representing a high portion of your overall assets. For example, if you are investing $10,000 and that represents 70% of all your savings and assets it wouldn't be wise to invest in cryptocurrency as you could lose that money easily.

The best type of investment is the one you are most comfortable with to help you attain and achieve whatever financial goal you might have such as buying a house or having your money grow to beat inflation in the future. If you're conservative, a guaranteed investment certificate (GIC) might be the best investment for you. If you are young and looking for growth to help with retirement decades from now, an equity investment like stocks or mutual funds might be the best investment for you.

Cryptocurrency is a type of speculative and risky investment. It has potential for great returns but at a risk and as such great losses. We advise you invest an amount you're comfortable losing and not attached to a specific financial goal like buying a house in the future.

It starts with a brief discussion to get to know you and understand what your goals and objectives are including your appetite for risk. You will get a chance to understand how we work as far as investment philosophy and strategies and how we can help you apply those to your investment goals.

You can contact us directly via email or phone. Alternatively, you can book a 15 minute appointment on our calendar.

- Stocks

- Bonds

- GICs

- ETFs

- Cryptocurrency

- Segregated Funds

- Alternative investments

- 91.5% of your investment returns will come from diversification as you can't predict which type of investment will perform the best in any given year.

- Don't time the market. It's better to stay invested so you don't miss out on the best days of the market in the long term

- Rebalance your portfolio based on economic and market data. Yes, things go up and down but sometimes it's better to make adjustments that are sensible

- Have a plan and objective for your investments

- Most investing is emotional so it's best to prepare and think for the long term

- Know what you own and why you own it

Are you still curious about investing?

Get in touch with us to find out our investing philosophy and if it fits with what you are looking for.