Insurance. Investments. Retirement

Best Financial Advisor in Bowmanville, ON

Independent financial advisor in Bowmanville for investment & retirement planning.

Personalized planning and investment advice from an experienced financial advisor in Bowmanville.

Do you know where you stand? Have you covered all the gaps and vulnerabilities that could derail your financial plans? Get started with the best from a Bowmanville, ON financial planner today!

Bowmanville, ON Financial Consultant

Simplified financial advice.

As a Bowmanville financial consultant our goal is to help you organize what you're currently doing. We will never undo any good work you've done up to this point. We'll just help you identify and fix any gaps or vulnerabilities in your current financial planning.

Financial Planning Comes Down To Your Income

"Protect Your Income. Grow Your Income. Replace Your Income."

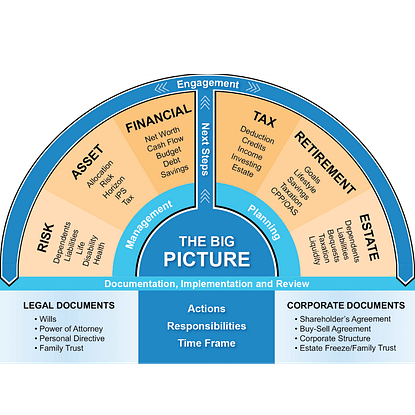

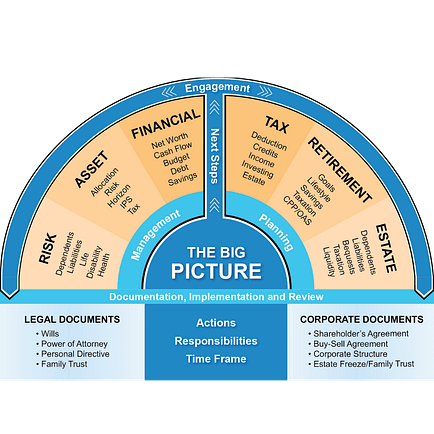

What part of your income do you need help with? There are 6 pillars to financial planning and they can be broken down so you don't feel overwhelmed about having to do everything at once. Start small then build on your progress.

Protect Your Income

Problem: You're more likely to get a major illness or disability than die before retirement.

Solution: Disability insurance.

Grow Your Income

Problem: Inflation eroding the purchasing power of your savings in retirement.

Solution: Investing strategies that change with market conditions.

Shelter Your Income

Problem: Asset location (e.g. RRSP) and allocation (e.g. interest, cash) will impact your taxes.

Solution: Invest in tax advantaged vehicles.

Guarantee Your Income

Problem: You risk running out of money in retirement due to market and health risks.

Solution: Use a portion of your nest-egg to create a personal pension using an annuity to cover basic expenses.

Replace Your Future Income

Problem: The risk that you die too soon and your family depends on your income.

Solution: Replace your income with life insurance because your income is what they depend upon for their lifestyle.

Distribute Your Income

Problem: Your assets and money not going to the people and causes you wish but to the government.

Solution: Your income triggered by your death will need to be distributed properly through a Will to avoid probate.

Working with us as your Bowmanville financial planning advisor.

Start with your greatest financial need today and we'll help you map out a plan or provide guidance on how to plan. Curious about working with a professional financial advisor? Here is what it looks like:

We have an initial phone conversation to determine your situation. This helps our discussion and to identify any immediate areas you need to address.

We then gather financial information and documents relevant to your planning needs. The better the inputs the better the advice.

Our focus is not to make the process overwhelming for you. We will start with a One-Page Financial Plan for each area that you identify as important. You start where you want by bringing together your goals, resources, risk appetite for that financial need. We then advise you on the best strategy to move forward.

With your agreement and understanding we start to execute your financial plan with the aim of making tangible progress. We start by opening appropriate investment accounts, re-allocating investments and any other steps required.

Here we go over our findings and inputs where you ask any questions in depth to get a sense of what we are advising you to do.

We typically meet with clients 2 times a year to discuss any life changes that may affect your plan and updates and information you may be interested in. You ultimately choose how often you want to meet ultimately and what you want to discuss.

Don't know where to start?

Explore some of the services and solutions we provide as a Bowmanville, ON financial advisor working with people from all walks of life.

Role of a Financial Advisor

As a financial planner, our goal is to help you uncover any financial gaps or vulnerabilities in your current situation.

We will never undo any good work or planning you have done with your finances up to this point. We will advise you on the best options and solutions.

Since we are independent, you can trust that we will always guide you with your interests at heart.

Most of what we do is help you organize what you're currently doing...from investments, financial planning and insurance.

Bowmanville, ON

Financial Advisor

Services

-

investment planning

-

life insurance

-

retirement planning

-

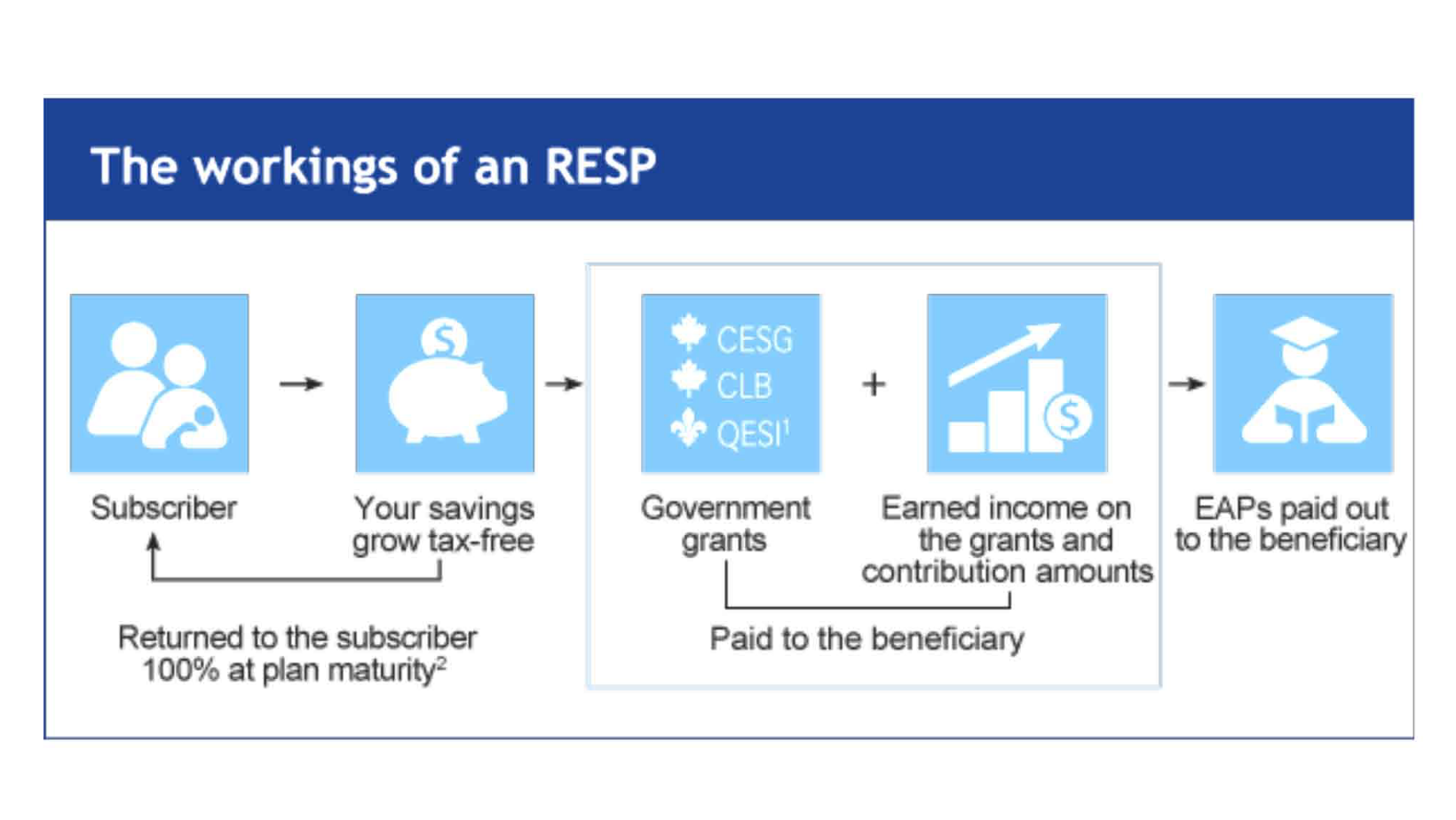

registered education savings plan

Disability Insurance

There's a reason there's 91,386 doctors and specialists in Canada and 797 funeral homes. Disability insurance is paycheque protection. If you suffer an injury or illness and need to take an extended time off work, disability insurance will replace your income. People are suffering more from debilitating diseases and injuries. Disability insurance ensures that your income is protected and you can maintain your lifestyle.

Are You Ready to Work With A Financial Planner?

As your experienced Bowmanville, ON financial planner, I will seek to uncover all the gaps and vulnerabilities that you may not have considered in your financial plan. I don't believe in perfect financial products but perfect financial planning.

My goal is to provide you the individualized financial advice you need to achieve the income protection and retirement goals you aspire for. Let's get started!

advice is only as good as the person you ask!

Carter Njovana

Bowmanville, ON Financial Advisor

Hi, I'm Carter, your independent financial advisor and partner in helping you gain control and security over your investing & financial planning needs. My extensive experience with investing and insurance strategies, particularly disability insurance, can help you tremendously in allowing you to plan proactively to protect and grow your wealth.

You'll find that having a discussion about how to simplify your situation helps to alleviate the anxiety that comes with financial planning and the associated products. I don't promise a silver bullet but promise to help make an improvement on your current situation. Get a feel for me if think it's worth your while?

Experienced financial planner in Bowmanville.

Curious about working with a financial planner? Get a feel for us. Fill out the form and we'll get back to you.

"I mostly help people organize what they're currently doing..."

contact us

Financial advisor near Oshawa, Ontario

Bowmanville Financial Advisor FAQs

It starts with having a conversation. A financial planner is only as good as the satisfaction you get in them helping you achieve your goals and your belief that they can. By having a conversation you can determine if your personalities are suited and if you can work with them long term. Get in touch with us and we'll answer your questions.

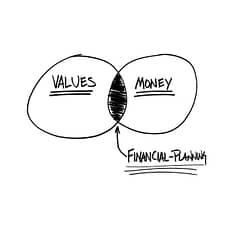

A financial advisor is a broad term reflecting an individuals ability to help you with money management, insurance or general advice. A financial advisor can also be a financial planner. A financial planner helps you put your financial situation together and plan for specific goals like retirement, kids education and debt reduction.

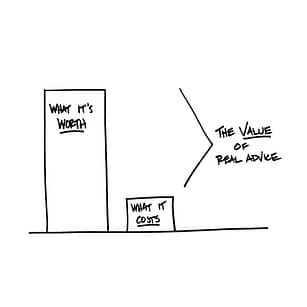

The cost of advice can vary from one financial consultant to another. You could pay for consultation such as when you request a detailed financial plan. Or you could pay a fee based on the value of the investments that a financial advisor manages for you. BlueAlpha Wealth is a fee-based financial advisor meaning you don't pay us commissions but a fee based on our performance of your investments. In addition, if you require a financial plan we have different amounts depending on your need and complexity.

With the information age and the vast amount of information available to consumers, many are and do manage their own investments and financial planning. It's easier now to buy investments online without speaking to a financial advisor. There are some drawbacks and limitations, however, to DIY. Knowing when to buy a stock is easier than knowing when to sell. You also may not have the time and focus required to manage your affairs as your life gets more complicated. If you want to buy life insurance, you have to go through an advisor to be able to find you the best company and coverage. So it's a trade-off that one has to decide for themselves.

Most of what a financial advisor does is help you organize what you're currently doing as well as pointing out gaps and vulnerabilities to your financial situation. At BlueAlpha Wealth we will never undo any good work you've done up to this point. Our focus is to help you manage and plan so that you fulfill your goals. Whether it's investing smartly or mapping out a plan that takes into account your whole financial situation, we meet you where you are. We may also point out different strategies like alternative strategies and investing than you might be used to at your local bank.

Our main role at Blue Alpha Wealth is investment planning and management. However, this is not in a silo as we help you apply managing your investments to fund particular goals and plans you have for the future. We help you create a one-page financial and investment plan and manage it on your behalf. It's a long term relationship and for individual investors who want to delegate this responsibility as well as working together in partnership. If you have for example an RRSP, TFSA or any other type of investment services you need guidance with, that is what we mostly do.

No, our initial conversation is more introductory and an opportunity for you to know what working with us looks like and who we help. You never pay us directly for any solutions we recommend and implement.