Non-Cancellable & Guaranteed Individual Disability Insurance For Doctors & Dentists.

Want better policy provisions? Have you outgrown your association group disability insurance plan? Physicians and dentists need true own-occupation coverage.

Disability Insurance for Doctors Made Simple.

Compare disability insurance quotes for doctors and features from the best insurance companies in Ontario.

Get exclusive discounts and advice on the best specialty-specific disability insurance for doctors. Blue Alpha Wealth is an experienced independent agent to help answer your questions and help you protect your income.

How It Works - Disability Insurance for Doctors

We help you find the best disability insurance policy by advising you on the best options.

Complete the Form

We ask a few questions about what stage you are in your career and about you and your needs.

Get Your Rates

Walk through scenarios with you to compare features from the best physician-focused disability insurance companies in Ontario.

Get Your Coverage

We finalize and secure your disability insurance policy with your chosen features and standard own-occupation disability .

Own-Occupation: The Best Feature of Disability Insurance for Doctors

get the best own-occupation disability insurance for doctors in ontario.

As long as you're unable to perform the important duties of your "own occupation" the disability insurance companies will pay your monthly benefit. As a physician this could mean if you can't perform the functions of your specialty such as carrying out a surgery.

The nice thing is, you will be paid by the insurance company even though you are able to do office work or lecture. They will pay you in addition to your 'extra-curricular' income while you recover to get back to doing your "own occupation".

Ready to See What Disability Insurance Coverage You Qualify For?

Click on the button below to complete a form to get started for disability insurance rates based on your own specialty.

Why Physicians Need Disability Insurance

Do you picture yourself with a disability?

No one ever imagines a disability happening to them. However, in the event that it does happen, as a highly trained practitioner with a profitable practice and used to a certain lifestyle, what impact do these questions have on your perspective?

Facts About the Ontario Medical Association (OMA) Disability Insurance Plan

Your Disability Rates Are Based On The Claims and Health Of Others

The Ontario Medical Association disability insurance plan is a group plan. You are part of a group of other physicians in Ontario. As a result your doctor disability insurance rates are based on the claims experience and health risks that the OMA has to factor in to stay profitable as well as meet their obligation of paying you when you get sick or hurt.

What this means is that your doctor disability insurance rates will always go up even though you may never claim or you are in good health. This is because your rates are affected by others in the group. You have no control over this unless you switch to a private individual disability insurance plan.

In June 2021, the OMA increased your rates. Even though you got an almost 50% rebate of premiums in 2010, this was cancelled in 2017 and rates increased again. The trouble for you is that rates will always continue to rise especially now after the Covid-19 pandemic.

Frequently Asked Questions About OMA Disability Insurance Plan

Disability doesn't just happen to an individual. It happens to a family, a business, a lifestyle. We strongly believe that the best disability insurance is the one you have in place when you and your family need it the most. This is because disability happens unexpectedly dues to illness or injury. So, if you have some money coming in that is better than nothing.

However, if you have the opportunity to choose, we believe perfect planning is a step better. If you can plan your disability insurance properly, it means less anxiety and more time to recover and get back to as close as possible to being whole. It starts with getting the most appropriate doctor disability insurance quotes that match your specialty and need. Here are some questions to consider if you wonder whether the OMA plan is appropriate for you and you'd like something more customized:

You can log into your OMA Account: www.oma.org/myaccount go to my insurance and click view details. There you'll get all the information you need to learn more about rate increases.

This is because you are part of a group or association plan. So while you get the perks and benefits of a group plan like discounts, you also get the pitfalls. Your rates are based on the OMA "grouping together" the health and risk of every physician on the plan. This means that if you have a good record you subsidize those that don't have favorable profiles. The insurance company then has to account for this with regular rate increases.

If you buy an individual disability insurance plan with an independent broker like Blue Alpha Wealth, your rates are based on your health and risk profile and don't increase as often as the OMA.

Sun Life Insurance.

The current OMA group disability insurance plan terminates at age 70, unless you opt for the 70+ extension. You can buy your own private disability insurance plan to cover you until age 100 even after you've retired.

o The OMA plan does not provide a minimum inflation protector.

o With a private plan you get a recovery benefit which is not available with OMA disability insurance.

o In the event of a re-occurring disability within 12-months, private disability insurance provides you protection whereas the OMA plan does not.

o You can convert a portion of your private disability insurance plan to a long term care benefit for home and facility care when you're unable to care for yourself. The OMA plan does not provide for this.

The Ontario Medical Association group disability insurance plan is purchased on a banded rate which means your OMA rates increase at age 30-34, 35-44, 45-54 and at age 56-64. Your private disability insurance rates are guaranteed and cannot be changed or cancelled by the insurer. Only you can change your plan.

This is called "portability". The main advantage of an private individual disability insurance plan is that it's portable as long as you continue to pay the premiums. If you leave Ontario, you need to pay OMA fees to keep your insurance.

Yes, and this is the main disadvantage of being part of a group or association plan due to many moving parts and individuals on the plan that could force the OMA to change definitions to stay profitable. These definitions could negatively impact you or increase your rates. The OMA and Sun Life have the right to make changes at their discretion.

2018 saw the OMA cancel the rebate on their disability insurance plan in addition to making material changes to the definitions of a disability. Furthermore in 2019, the OMA changed the definition of total and partial disability which negatively affected your ability to make a claim with confidence.

In short, you don't control the plan. Under the OMA group disability insurance plan, the insurer (Sun Life) controls your disability insurance. If you leave the OMA, you need to pay OMA fees to maintain your insurance because it is not portable. This is similar to mortgage insurance.

Total disability definition has been updated and reverts to an any occupation definition of disability after 24 months. … “After the total disability benefit has been paid for 24 months, then total disability means the insured is under a physician’s care and due to sickness or injury is unable to perform any gainful occupation which the insured is or may be reasonable qualified by training or experience.”

A partial disability with the OMA requires that you have a minimum number of hours at work. With the OMA there is also no minimum payment if you are partially disabled compared to 50% with a private disability insurance plan.

Similar to an individual private disability insurance plan, they look at your age, gender, smoking status and general health. The OMA, however, also places a greater emphasis on looking at claims experience from the whole group for your specialty and accounts for that in calculating your rates.

Ready To Switch From Your Medical Association Plan To An Individual Disability Insurance Plan?

Switch or Replace Your Ontario Medical Association Group Plan To A Private Individual Disability Insurance Plan.

Most People Don't Imagine A Disability Happening to them because this is what they picture.

What Does Disability Mean To You?

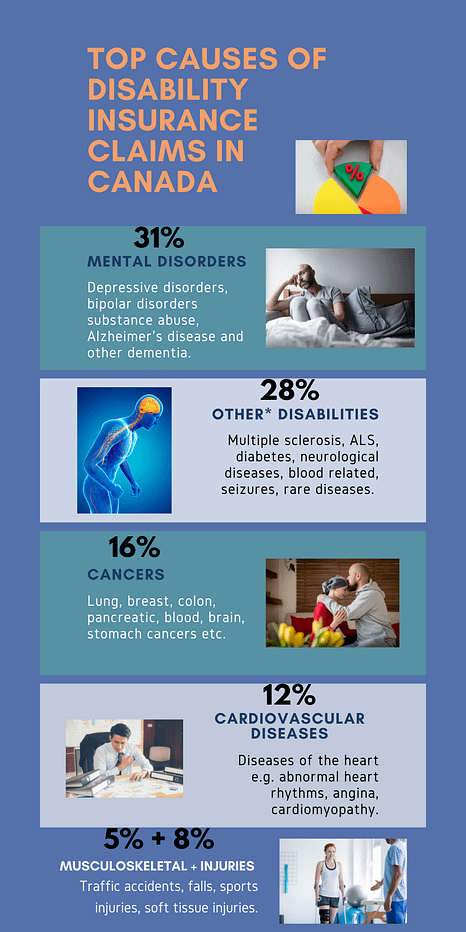

Disability is silent. Disability insurance claims are mainly long-term illness and sickness and less than 10% from injuries and accidents. Disability insurance is meant to make you as whole as possible before you made a claim.

Frequently Asked Questions About Disability Insurance

In general, you can calculate based on average. On average, for a standard disability insurance policy, it will cost a doctor between 1% - 4% of your income. Another rule of thumb is 2% - 6% of your benefit amount on a monthly basis. For example 2% of a $10,000 monthly disability benefit would be $200/month. What factors go into calculating your disability insurance quote?

How Is My Rate Calculated?

- Age, Gender and Smoking Status

- Health such as medical history, prescriptions you take and pre-existing conditions

- Medical specialty

- hazards of your job

- how difficult it is to return to work following an injury or illness

- claims history for your particular specialty

- Financial underwriting such as your income, past bankruptcy, earned and unearned income

- Benefit length i.e. do you need coverage to age 65 or for life

- Elimination period - how long can you go before you start getting your benefit paid? This is like a deductible which will make your cost lower. For example, most doctors request a 90 day waiting or elimination period.

In short, the OMA plan is a type of group plan which is insured by Sun Life insurance. This means, they "group" you together with other physicians across Ontario. They group their illnesses, claims, risk etc. together with your and use this to calculate your rate. What that means is your rates will go up often because if you are a good policyholder you will be used to underwrite the "bad apples" in the group.

- Your OMA rates are not guaranteed. Our rates are guaranteed and protected.

- Under OMA, Sun Life controls your policy. With a private plan you control and own the policy

- OMA has more definition restrictions to your plan compared to private plans. This may not seem important until you make a claim.

- Total disability definition reverts to "any occupation" meaning if you can do any job you are required to take that. We offer "own occupation" which requires you to go back to your specific specialty.

Blue Alpha Wealth is an independent broker for disability insurance. With an individual insurance plan, your rates are locked in as long as you pay your premiums and you get better and more generous policy provisions and guarantees on your definitions of a disability. The insurance company cannot make changes to your policy unlike the OMA plan, only you can change your policy.

Any type of disability plan you have in place to protect and replace your income in the event you can't work due to sickness or injury, is the best plan to have. However, if you have an opportunity to plan it out in thinking about future needs and protections, here are some important features to have in your disability insurance plan as a doctor.

- Own occupation definition of disability that pays until you're only able to do the duties of your specific specialty.

- Non-cancellable and guaranteed renewable insurance policy. Only you can cancel and change your policy and the insurance company guarantees your policy will remain in-force.

- Partial or residual benefits. Partial benefits to cover you if you're able to still work but only partially. Residual to make you "whole" in terms of your earnings prior to a disability.

- Cost Of Living Adjustment rider. Inflation impacts the purchasing power of your money over time increasing your cost of living especially on a fixed income like disability insurance.

- Future Purchase Increase Option. Lock in the right to increase your coverage in the future as your income rises without worrying about your health status.

You choose what features are most important to you and adjust and add as you go along. Start with a good base at a price you can easily afford and benefit amount that will make you comfortable when you make a claim.

“You are not able to perform the material and substantial duties of your occupation, even if you are gainfully employed in another occupation. If you meet the definition of totally disabled and you become employed in a new occupation, your total disability benefit will not be affected by any income from the new occupation, regardless of the amount.”

Disability insurance benefits paid to you when you hold a private individual plan are not taxable because the premiums you pay have been paid with after-tax dollars. If you are a part of a group disability plan or an association-based disability plan like Ontario Medical Association, your disability benefits will be taxable if they were paid with pre-tax dollars.

Yes! If you want to make modifications to your application and add or remove features to a standing policy at any time. Just get in touch with us at Blue Alpha Wealth.

There are association and hospital discounts that arise from time to time with insurers like RBC Insurance to provide affordable disability insurance coverage. In many instances, per case, we can negotiate a discount on your behalf.

No, not when you buy a disability insurance policy on an individual private basis. These types of policies are non-cancellable and guaranteed renewable meaning only you can change and cancel the policy. If there is a change it will be for every doctor your gender and age across the province and not specific to you individually. With a group plan like OMA, your plan changes regularly due to claims history of the whole group and how expensive those claims are to compensate for the plan.

Residual disability benefits cover a partial loss of income due to a disability. Residual benefits come into play for you when, due to a disability, you have a percentage loss of income, usually 15% or 20% depending on the disability insurance company. At that point, residual benefits will be paid out to you. Residual benefits can be included in the base policy or offered as an additional rider on a long term disability insurance policy that you purchase.

❝

With disability insurance the secret is in the contract language and understanding what the insurance company says they will pay for. That's why working with an advisor like Blue Alpha Wealth is beneficial.

Disability Insurance Advice & Guidance Is Only As Good As the Person You Ask!

Hi, I'm Carter, your independent disability insurance advisor and specialist. I started advising clients on disability insurance and protecting their income more than 10 years ago as I understood that without an income you can't build wealth or have assurance of making long term plans. I also learned early on that disability happens to a family, not just an individual. It affects your whole family not just financially but emotionally. I understand that no one likes to imagine being incapacitated for a long time with no money coming in. Let's have a conversation to start and see if it's worth your while to plan perfectly with us so you feel secure.

As a physician or specialist in Ontario you Need true own occupation disability insurance.

Compare disability insurance rates and features with us as we walk you through the process to get you the most appropriate coverage. The Ontario Medical Association group plan is a good start but not the best option for any practicing doctor in Ontario. You need own occupation coverage for your specialty that can't be cancelled or changed. You are unique - haven't you graduated from a group plan like the OMA?

We work with various Ontario Medical Associations and Hospitals for their private disability insurance plans.

Get specialty-specific disability insurance rates for doctors in Ontario. Better definitions & policy provisions vs. Ontario Medical Association plan. Compare today!

Curious About Getting Started?

Blue Alpha Wealth